Boost super in your 40s or kiss your lifestyle goodbye

In July 2017, the government introduced new rules that make it imperative for higher income earners to pay close attention to their annual super contributions or risk retiring without enough money to fund their lifestyle.

Until then, high income earners had been able to play catch-up later in life when mortgages were paid off and more cash was free to top up super. However, the new caps on super contributions limit this option and make it crucial to boost your super as much as possible each and every year on the journey to retirement.

Super contribution changes

The big change was the lowering of the concessional contributions cap from $30,000 (or $35,000 for those over 50) to $25,000 for everyone, regardless of age. Concessional contributions are those that are typically paid by your employer to super, including your salary sacrificed contributions, and are taxed concessionally at 15%, hence the name. Over 10 years this change could mean $50,000 or $100,000 less in contributions to super, depending on your age.

The good news is you can carry-forward any unused amounts up to five years. This means in any five-year period, your concessional contributions cap will be $125,000, allowing you to make contributions when you have the funds.

Taking control of your super

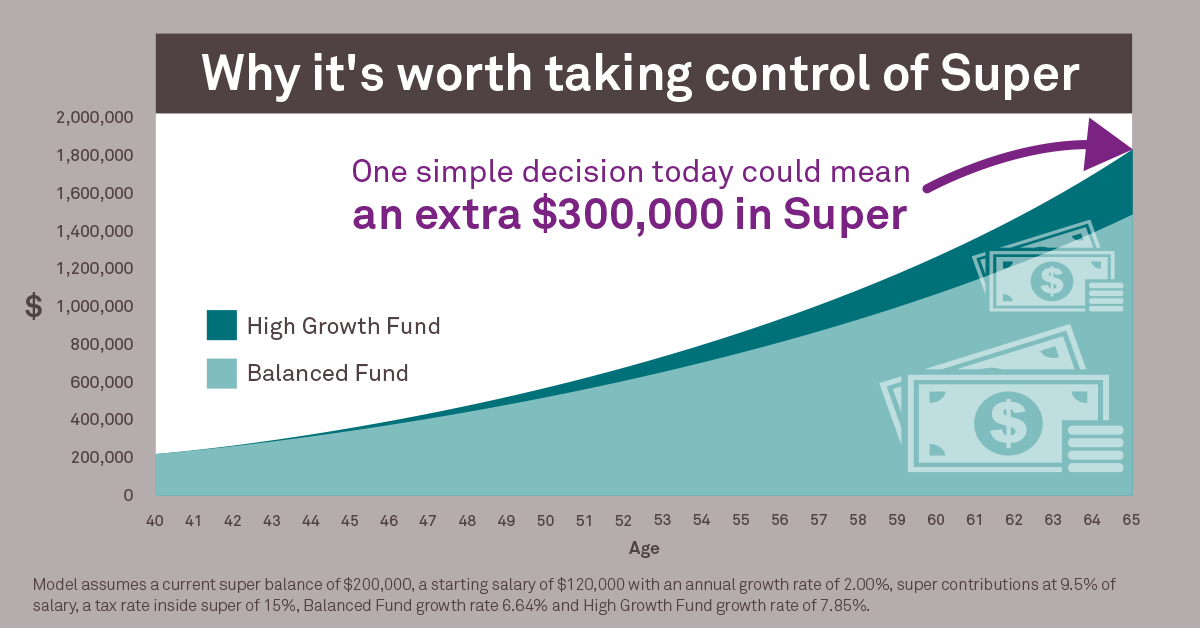

So, if you’re in your 40s or 50s, it’s time to ask yourself, ‘How much could your super grow if you made an active choice about your investment strategy today?’ It could mean more money in retirement – I mean a lot more money, an extra $300,000 for example.

You may only give your super balance a passing glance now, but before you know it you’ll be relying on it to fund your lifestyle. Consider that for a minute, then look at the below numbers. They show you how you could have an extra $300,000 in super by making a single decision: moving from a Balanced Fund to a High Growth Fund.

It’s certainly not for everyone, but it’s got to be worth an hour of your time to work out whether it is for you, right? The thing is, most people don’t take that hour. Instead, most people sign up to their employer’s default fund and let their super take care of itself; until far too late. By choosing the default fund and not seeking advice, you are effectively saying ‘I’ll let my super run its own course – whatever that may be.’

And while we’re at it, most people don’t make extra contributions either. Personal contributions in the March 2018 quarter fell by 26% as compared with the March 2017 quarter [1], yet making personal contributions is something that frequently separates people who build long-term wealth from those who don’t.

The bottom line? The lifestyle you’ll enjoy when work is behind you is about the action you take now.

How investment advice can help

If you’re ready to take control of your super and build more wealth for the future, a qualified financial adviser can help you:

• Develop a financial plan to help you boost your super through tax effective investment strategies

• Assess your risk profile to ensure your super is invested for growth in a way that you're most comfortable with

• Assist with the onerous administration and reporting requirements associated with an SMSF

Book in for a free financial health check with a qualified adviser. There’s nothing to lose and everything to gain.

Take the next step in maximising your super

[1] (Personal contributions in the March quarter 2018 were $3,876 million, down from $5,305 million the same quarter a year earlier – AFSA stats)

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.