2022 Federal Budget Update

Introduction

With the pending election front-of mind for the Government, the Treasurer has handed down a relatively responsible Budget, with a strong focus on cost-of-living measures along with some small-business support, cyber-security and infrastructure spending.

The backdrop to this Budget has been concerns regarding rising inflation, the Russia-Ukraine war and its ‘flow-on’ effect to fuel prices and other supply-side issues. On the positive side, the Government has benefited from an unexpectedly strong Australian economy with higher-than-expected GDP growth and near record low unemployment rates. This has given the Government a lower than forecast budget deficit from the previous years’ COVID-19 induced spending, enabling them to spend a little more freely.

It’s important to keep in mind that the Budget announcements remain proposals at this stage and must be passed by Parliament before they become law and may be subject to change. Although the measures slated to come into effect from Budget night are expected to be approved before the Senate goes into recess next Wednesday.

How do the Budget announcements impact you?

We have prepared a summary of the most relevant changes, but as always, please speak to your FMD adviser if you have any questions about your personal circumstances.

Cost of Living Support

$250 One-off Payment

To assist with the increasing cost of living experienced by Australians, a one-off support payment of $250 will be made to eligible recipients, such as those on the Age Pension, Disability Support Pension and Carer’s Payment along with those with Commonwealth Seniors Health Cards and Pensioner Concession Cards. Notably, this amount will be paid in April 2022 and is expected to cost the budget $1.5bn.

Cut in the Fuel Excise

With fuel prices in Australia rising above $2/L recently, the Fuel Excise will be cut from 44.2c/L to 22.1c/L for 6 months. This is effective immediately but will likely take several weeks to flow through to retailers. This will assist in easing fuel bills for families and businesses by approximately $15 for a mid-sized SUV per tank.

Support for Pharmaceutical Benefit Scheme

Effective from 1 July 2022, the safety net for the Pharmaceutical Benefit Scheme will be lowered so that people reach this threshold sooner. It is expected that concession patients will need 12 fewer scripts and general patients 2 fewer scripts to reach this threshold. This provides some relief for those that have high demand for prescriptions.

Superannuation

Reduced Minimum Pensions

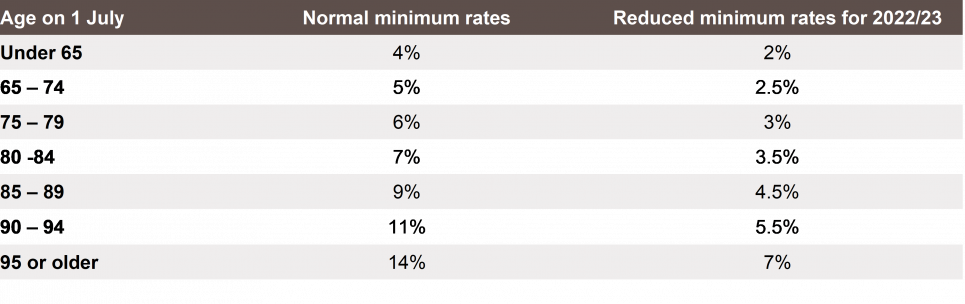

The current temporary reduction in minimum drawdown rates for super pensions will be extended for 2022/23. This applies to account-based pensions, term allocated pensions and transition to retirement pensions. The table below summarises the reduced annual minimum pension rates for account-based and transition to retirement pensions:

Interestingly, several retiree lobby groups have been very actively working to ensure these changes become permanent – something to monitor during the election.

Personal Income Tax

Increasing the Low- and Middle-Income Tax Offset for the 2021-22 financial year

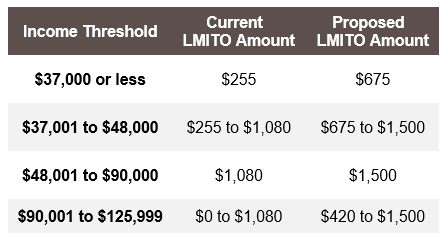

For the final year of the Low- and Middle-Income Tax Offset (LMITO) it will be increased to a maximum of $1,500, to provide additional tax relief for low- and middle-income taxpayers. This is a one-off increase of $420 to the existing LMITO as follows:

Increasing the Medicare Levy low-income thresholds

The Medicare Levy low-income thresholds for singles, families, seniors and pensioners is set to be increased effective from 1 July 2021 ensuring that low-income taxpayers generally continue to be exempt from paying the Medicare Levy.

Home Ownership and Affordability

Home Guarantee Scheme

The Home Guarantee Scheme has been proposed to be expanded to 50,000 places allocated over the three guarantee programs for the year 2022-2023 and 35,000 places per year ongoing.

This will help eligible first homeowners building or purchasing a new home access to loans with a deposit as low as 2% without having to pay lenders mortgage insurance.

First Home Super Saver Scheme (FHSSS)

There is no change to the proposal in last year’s Budget to increase the maximum amount that can be withdrawn under the FHSSS from $30,000 plus notional earnings to $50,000 plus notional earnings, proposed to come into effect from 1 July 2022. The yearly cap of $15,000 for these contributions is still applicable.

Business Support

Small Business Tax Benefits

Approximately $2.1 billion in tax cuts are expected to be delivered to small businesses (with aggregated turnover under $50m) in 2022-23, along with access to 120% deductions for upskilling employees and ‘going digital’ i.e., assisting with the costs of devices, cloud computing and cyber-security systems.

Tax Deductibility of COVID-19 Test Expenses

The Government will allow the cost of supplying COVID-19 PCR or RAT tests to employees to be tax deductible avoiding any Fringe Benefit Tax (FBT) issues.

Apprentices

The Government will spend $2.4 billion over four years for a revamped apprentice scheme, replacing the existing system due to end on 30 June 2022. This will include wage subsidies, hiring incentives, and cash payments for training new apprentices.

Infrastructure and Other Spending

The Government has announced additional spending in its budget; $18 billion for new road and rail projects, $15 billion on defence spending and $9.9 billion to tackle cyber issues.

Environmental spending includes: $250 million to support low emissions technology including hydrogen, $60 million to improve recycling of plastics and $1 billion on Great Barrier Reef (already announced).

Families

Enhanced Paid Parental Leave

The Paid Parental Leave scheme is to be enhanced by combining ‘Parental Leave Pay’ and ‘Dad and Partner Pay’ into a single scheme of up to 20 weeks leave, which can be shared between eligible parents and can be taken any time within two years of the birth or adoption of their child. The aim is to provide more flexibility for families to decide how to best manage work and care.

Download 2022 Federal Budget Update

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.