The six things financial planners say matter to your future

There may not be a formula for creating health, wealth and happiness, but nearly two decades of providing personalised financial advice to clients across Melbourne, Brisbane and Adelaide has taught us that taking the right steps in six key areas of personal financial management makes all the difference to the lifestyle you can afford at every stage of life.

1. Set goals to feel more satisfied with life and less stressed about money

Setting financial goals is tough because it means taking reflective time away from our busy lives and thinking specifically and realistically about what we want from our hard-earned money. That’s why the simple act of talking with a good adviser can help you crystalize your goals sooner.

2. Pay yourself a portion of your income and save or invest the rest

On each pay-day, pay yourself a pre-decided percentage of your income. The rest goes into your savings or investment account as part of a tax-effective strategy.

On each pay-day, pay yourself a pre-decided percentage of your income. The rest goes into your savings or investment account as part of a tax-effective strategy.

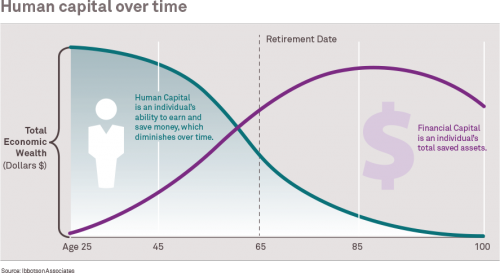

There will be months where you’re unable to save anything, don’t let that derail you. Your income is the best financial advantage in your intensive working years, so make sure that income brings you the biggest returns.

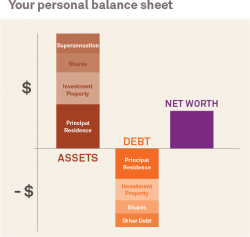

3. List your assets and debt and understand your personal balance sheet

With a rising cost of living, stagnant wages growth and a slower investment growth, it’s easy to feel like you’re working hard but not getting anywhere. Knowing your asset to debt ratio helps your determine your equity levels so you can develop a plan to pay off debt and own your assets sooner.

In reality, having to pay off a debt such as a home loan, doesn't mean you can't grow your wealth. Click here to read about how you can use your home loan debt to acquire more property or invest in shares.

By chatting with a financial adviser, or by taking our online profiler, you can understand your personal balance sheet and unlock your true investment potential.

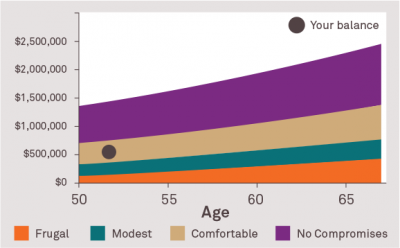

4. Seek professional advice to actively invest your super. Neglected super is the most common mistake we see

Most of us are simply too optimistic about what our s uper will yield over time.

uper will yield over time.

Talking to a professional financial adviser can help you understand if you’re are on track for a future that is frugal, comfortable or one in which you don't have to make any compromises on the lifestyle you want.

When you know what to expect, you can do something about it. From salary sacrificing to investing within your superannuation, there are many ways to get more money behind you earlier.

5. Find out what type of insurance you need, and how much

The earlier you start, the better the policy you can access. At age 40, many policy exclusions kick in, so it’s advisable to get your insurance before then. No longer just for the rich or the aged, insurance and income protection are essential to maintaining your earning power - and your lifestyle - in an uncertain world. This article is a great starting point to understand how to work out your insurance needs.

6. Discuss your financial legacy with the people closest to you

Every day we meet clients, friends and colleagues with families, businesses and assets, who don’t have a valid will in place. While it can be emotionally challenging to plan your estate in the prime of your life, sorting out your will is more important now than ever. Talking to a professional financial adviser will help you get started on this difficult but vital step towards financial control.

How do you score on the health, wealth and happiness scale?

Curious about where you score on the health, wealth and happiness scale? Find out in less than 10 minutes by taking our unique online profiler at http://www.fmd.com.au/health-wealth-and-happiness-project.html

If online tests are not for you, you can also book a free consultation with one of our qualified advisers who can take you through it, face-to-face.

Click here to book a free consultation with a qualified adviser

This 1-hour session will give you a deeper understanding of your finances. There's no charge for this meeting because we want to make sure we're right for you and you're right for us.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.