Regular financial updates in response to Coronavirus

COVID-19 Update: Thursday, 27th May

Melbourne Office Service Continuity Throughout Victorian Lockdown

The Victorian Government today announced lockdown conditions will be applied statewide across Victoria for the next 7 days, commencing from midnight tonight.

Under these restrictions, financial service providers will be required to close their offices and have their teams work from home wherever possible. While this means that our office at 367 Collins Street will not be accessible for the near future, we want to reassure you that this will not impact FMD’s ability to continue providing the services you require.

As you would be aware, FMD staff in the Melbourne office have been working remotely on and off since the first restrictions were implemented in 2020. As with previous lockdowns, we will maintain our service continuity through the following means:

• Clients can continue to contact their adviser at any time over the phone or via email.

• Meetings can take place via Microsoft Teams, our preferred platform, or via Skype, Zoom or on the phone.

• FMD advisers and staff all have remote access and can continue to work securely and productively from offsite locations.

• The FMD Investment Committee and your adviser will still be able to enact all client portfolio transactions as per normal.

We hope that everyone is managing through this ongoing situation as best they can. Please be assured that our key priorities remain:

• the health of our clients and staff;

• providing continuity of management for your financial affairs; and

• maintaining the quality of our service delivery.

These are unsettling times, but FMD remains in an extremely strong position to support you and manage your investments with the continuity, calm and rigour you expect. We also continue to monitor the situation and will keep you informed of any information of material importance via email and through this Coronavirus rolling update.

We hope you and your families are safe and as comfortable as possible and if you have any queries or concerns, please don’t hesitate to get in touch to discuss any of the above in more detail.

COVID-19 Update: Friday 7th August

Service Continuity throughout Stage 4 Restrictions

Earlier this week, the Victorian Government announced stage 4 restrictions will be applied and financial service providers will be required to close their Melbourne offices under the new lockdown rules. While this means that our office at 367 Collins Street will not be accessible for the near future, we want to reassure you that this will not impact FMD’s ability to continue providing the services you require.

As you would be aware, FMD staff in the Melbourne office have been working remotely since March of this year, after the first restrictions were implemented. Since that time, we’ve maintained our service continuity through the following means:

- Clients can continue to contact their adviser at any time over the phone or via email.

- Meetings can take place via Microsoft Teams, our preferred platform, or via Skype, Zoom or on the phone.

- FMD advisers and staff all have remote access and can continue to work securely and productively from offsite locations.

- The FMD Investment Committee and your adviser will still be able to enact all client portfolio transactions as per normal.

We hope that everyone is managing through this ongoing situation as best they can. Please be assured that our key priorities remain:

- the health of our clients and staff;

- providing continuity of management for your financial affairs; and

- maintaining the quality of our service delivery.

These are unsettling times, but FMD remains in an extremely strong position to support you and manage your investments with the continuity, calm and rigour you expect. We also continue to monitor the situation and keep you informed of any information of material importance through this Coronavirus rolling update as well as via our COVID-19 Resources page, where the latest information on the State and Federal Government Economic Stimulus Packages is now available.

We hope you and your families are safe and as comfortable as possible and if you have any queries or concerns, please don’t hesitate to get in touch to discuss any of the above in more detail.

COVID-19 Update: Friday 24th July

Early access to superannuation also extended

The Federal Government has announced that it will extend the early super access scheme amidst new economic data. The application period for early access to superannuation will be extended from 24 September to 31 December 2020 for individuals who are still financially impacted by COVID-19. The most recent APRA figures put early super withdrawals at $28 billion, slightly above the Treasury estimate of $27 billion.

FMD would like to take this opportunity to reiterate that accessing super early can have a significant impact on future wealth and should be seen as a last resort in response to financial difficulties.

Download this fact-sheet for more information https://treasury.gov.au/sites/default/files/2020-07/Fact_sheet-Early_Access_to_Super.pdf

COVID-19 Update: Wednesday 22nd July

The extension and tightening of JobKeeper and JobSeeker

Yesterday the Federal Government announced that JobKeeper and JobSeeker will continue beyond their original end date of September 2020 and will be in effect until March 2021. The extension is part of an extra

$20 billion in government stimulus to buffer businesses and households against the economic impacts of the pandemic. However, both payments will be reduced, and eligibility requirements will be tightened.

JobKeeper

Businesses will have to meet new turnover tests, and JobKeeper will be split into two tiers – one for full-time workers and one for part-time workers.

- JobKeeper for staff working more than 20 hours a week will reduce from $1,500 a fortnight to $1,200 in October and $1,000 in January 2021, until 28 March 2021 when these will be discontinued

- Part-time staff (less than 20 hours pre-COVID) will see their payments cut from $1,500 to $750 and then $650

- Businesses will have to reapply for JobKeeper at the end of September and again in January proving their turnover is still down more than 30 per cent (for small businesses) and more than 50 per cent (for businesses with a turnover of more than $1billion).

JobSeeker

Before COVID-19, JobSeeker, formerly known as Newstart, paid job seekers $560 a fortnight. This was increased to $1,100 with a $550 supplement payment that was due to end in September.

- The payments will be reduced from $1,100 to $815 a fortnight from September

- The Coronavirus Supplement of $550 per fortnight is available until 24 September 2020

- Beyond this date, the Coronavirus Supplement will be available at $250 per fortnight until 31 December 2020

Other eligibility criteria must be met, with some income and asset testing adjustment as part of this. For more information on the latest updates in the Australian Government response to COVID-19 visit https://www.pm.gov.au/media/jobkeeper-payment-and-income-support-extended

COVID-19 Update: Friday 3rd July

An uncertain winter

Most of us would like to be able to hold down the fast forward button to skip over the winter months ahead; a period that may feel more daunting for those who are used to chasing the sun north but are now locked down for the foreseeable future. The dreaded second wave may be beginning for Victorians, while its residents envy other states which are broadly easing restrictions. Swift action and adherence to recommended distancing and other safe practices are essential to get the current outbreak under control all of which have consequences for the economy.

Overall, Australia appears to have benefited from being able to shut borders both nationally and more locally to stem the worst of the virus spread. Seeing further case growth globally and the premature easing of lock downs, certainly in the US, we believe there is still a long road ahead of us before we know what’s next for the virus, economies and markets. A vaccine appears months away at best but is something that if successfully delivered would provide some much-needed certainty about returning to normal.

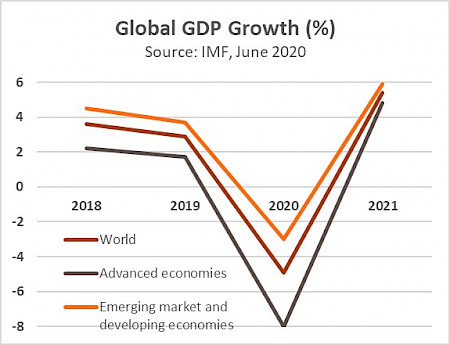

We’re looking for signs of a peak in the virus across the world to provide greater confidence that the road to recovery can more confidently begin. Investment markets, have to date, been looking through case growth. Although with higher cases continuing to be recorded, forecasters are now pushing out assumptions for when growth will return to normal. It’s likely that the worst economic data is still ahead of us, albeit with a likely turnaround in the latter part of 2020. A full recovery is not expected for a few years while governments try (or not try) to battle the virus spread.

Economic impact and market response

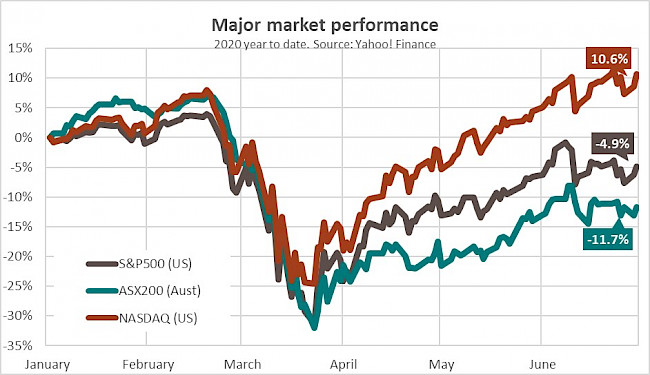

Even though the headlines are grim, in a range of data, we have seen evidence of the so-called V-shaped recovery. Leading economic indicators like purchasing manufacturer indexes (economists surveying businesses, asking them what their outlook is to assess whether they’re growing or slowing), online retail sales, consumer sentiment and some equity markets have rebounded from the initial shut-downs and fears of what the virus’s impact might be.

With the virus still spreading, the recovery in investment markets may be premature. For equity investors we are hopeful that it is sustainable, however we stress that valuations are at very high levels in many markets, suggesting a lot has to go right for share markets to maintain their current levels or keep growing from here.

As such, many professional investors are scratching their heads at current market valuations, struggling to justify the price rebounds, with a closer eye on risk and trying to avoid companies that may see longer-term impacts from a virus-recovery. Some companies are now trading on multiples that would require decades, not years, to make an economic return.

The Robinhood effect

Some of the market recovery has been put down to the prevalence of a retail investors with short-term investment time horizons. In some ways, these investors can be less sophisticated, and more sentiment driven, hunting for tips on where to find a winning company to back. So called ‘Robinhood’ investors – day-traders that have linked themselves in a crowd-style approach to an app named Robinhood and other tipping blogs or sites – are supposedly driving higher prices in certain pockets of the market, apparently pushing companies that have performed well, on to higher levels.

A by-product of this trading is seeing a higher level of concentration in specific companies. In the US for example, many of these retail investors are buying Apple, Microsoft, Amazon, Alphabet and Facebook shares. Collectively these mega-businesses now represent a proportion of around 11% of global share markets. Concentration on this level isn’t something we’ve seen since the tech-bubble of 2000. It is an emerging risk to monitor.

Some media sources are also commenting about a shorter-term phenomenon that has arisen in lock-down where people who would otherwise be trying to pick winners on the horses or football, are now punting on the share market. Hopefully with a little more sport to consume in future these punters will return to a different hobby.

As seasoned advisers, we know that day trading is fraught with challenges. It can be lucrative for a very small minority who invest many, many hours and have a deep and vast array of information sources. Yet it typically ends up doing more harm than good. Investing is a long-term effort and the power of diversification and compounding of wealth over years have shown to stand the test of many different markets, cycles and fads.

Consumer behaviour changes

Some interesting trends have been emerging too. While many consumers halted spending on non-essential items as the virus hit initially, ‘revenge-spending’ through online channels have kept delivery drivers busier than ever and retailers seeing 5-10 years of spending pattern changes towards online retailing, happening in a matter of months. Online gaming, Zooming with family and video-streaming services have all seen internet traffic remain high.

Increasing Isolationism

On the flip side, some more serious issues have arisen with geopolitical tensions becoming more strained and protesters showing a populous voice that is strengthening. More protectionist globalisation approaches are on the cards too, as some nations realise how reliant they were on certain trading partners for good and services. If a country can reach scale in certain industries this may see re-shoring of businesses; while it may be thought to be positive for jobs and supply chain management, it has a risk of creating inflation where nations struggle to competitively produce at prices that can be achieved by more efficient operations elsewhere. Should the scale be achieved, the economic benefits may again go to a smaller number of high-value businesses as automation and possibly robotics may be utilised more than in the past.

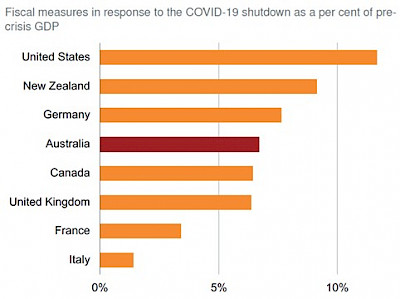

Stimulus works – but for how long?

Globally, governments and central banks had done a good job moving rapidly to provide support to people and businesses impacted by revenue declines related to COVID-19. Locally, around 7% of GDP ($136bn) has been pledged in business and employment support or stimulus. At this stage, some of the key policies are expected to finish in September or October. This may be too soon, and an extension may be needed to hopefully keep support going where it’s needed.

This will be a juggling act that will no doubt have unintended consequences. In Australia, where states that have successfully stopped the virus and are returning to normal, there may be less support needed than other states. Getting the right policies at the right time in this environment is going to be very challenging to provide. Further financial support around the world is likely to support economies on the road to recovery, including the likelihood of low interest rates into the future. These could be tailwinds for share markets.

|

|

Source: The Recovery Book: What Australian governments should do now,

the Grattan Institute

Investment outlook

It remains too early to make a call about the worst of the virus being behind us. There are any number of scenarios that could play out from here. Markets may continue to push on higher, suggesting that virus cases are not relevant and that economies will reopen fully in the coming months, with stimulus and low rates remaining a catalyst for higher market prices. Virus cases may continue to rise and second-waves occur in regions where cases were presumably under control; this scenario is likely to lead to further weakness in company earnings and a return to higher volatility and lower share prices. There is also a reasonable chance that markets trade sideways for a period, consolidating the recovery seen to date, awaiting evidence of improvements in conditions before a more persistent market trend re-emerges.

Overall, with this backdrop, it is hard to have a high level of conviction picking a market direction when there is a still a substantial amount of uncertainty.

We do know that there’s a heck of a lot of stimulus, which is usually positive for equities and normally leads to increases in prices including financial assets. We do know that interest rates are low and until there is sustained higher inflation, they are likely to remain low for the foreseeable future (could be many years). This will be a challenge for cash and fixed interest investments and considering a broader opportunity set beyond cash and term deposits will likely reward investors. We do know that for typically reliable income generating assets, like property and infrastructure the outlook is uncertain, usage has substantially reduced and questions remain as to whether they’ll return to full operating capacity in future, something no-one could have predicted at the beginning of this year.

Retaining discipline around valuations, diversification across asset classes, markets and investment styles will ensure a mix of return sources. Maintaining exposure to an array of professional investment managers also, where they too are assessing market cycles, investment opportunities and deploying money across a range of strategies also remains a wise approach in our view.

FMD update

We are back in the office in Adelaide and Brisbane teams and it seems business as usual will be working from home for our Melbourne team. We expect video or phone review meetings to be the standard approach for the foreseeable future. June is typically a hectic month for our team as we work towards end of year super contributions and seeking to maximise any advice strategies for the end of financial year, getting set for the new year. This year there was added complexity with pension reductions allowed. This carries on into 2020-21; for those in this situation it is worth re-calculating your budget for the period ahead and thinking about the right spending level given the likely extension of social distancing through the remainder of 2020 for many of us.

The new financial year brings a variety of regulatory changes for us, that we will be introducing too. This includes a new annual opt-in for all clients. It is something we’ll discuss in future client meetings.

Best wishes for the new financial year. Let’s hope we can get a sense of normality back soon.

COVID-19 Update: Thursday 4th June

The Federal Government has announced home-building grants of $25,000 for eligible owner-occupiers (including first home buyers) to provide stimulus to the building and construction sector.

The money can be used to substantially renovate an existing home or to build a new home. To be eligible, relevant building contracts must be signed between 4th June and 31st December 2020 and construction must commence within three months of the contract date.

Eligibility for HomeBuilder grant

Owner-occupiers need to meet the following eligibility criteria to access HomeBuilder:

- you are a natural person (not a company or trust)

- you are aged 18 years or older

- you are an Australian citizen

- you meet one of the following income caps: $125,000 per annum for an individual applicant based on your 2018-19 tax return or later; or $200,000 per annum for a couple based on both 2018-19 tax returns or later

- you enter into a building contract between 4 June 2020 and 31 December 2020 to either: build a new home as a principal place of residence, where the property value does not exceed $750,000; or substantially renovate your existing home as a principal place of residence, where the renovation contract is between $150,000 and $750,000, and where the value of your existing property does not exceed $1.5 million

- construction must commence within three months of the contract date

For more information visit treasury.gov.au/coronavirus/homebuilder

COVID-19 Update: Monday 1st June

By the end of May 2020, the Government's Scamwatch website had received over 2700 scam reports mentioning the Coronavirus, representing over $1,114,000 in reported losses. Some of these are superannuation scams.

Superannuation scams on the rise

As widely report in media, scammers have been cold-calling people claiming to be from organisations that can help them gain access to their super using the Federal Government’s early access scheme as part of their economic stimulus package.The Australian Competition and Consumer Commission (ACCC) has been quick to remind consumers that the scheme is being administered by the Australian Tax Office (ATO) via the myGov portal and there is no need to involve a third party or pay a fee to access it.

In 2019, Australians lost over $6 million to superannuation scams with people aged 45-54 losing the most amount of money. Scammers targeting the early access scheme haven’t discriminated against anyone, with people across all age groups being fraudulently approached. The ACCC advises people to type the full name of the myGov website into a browser personally rather than following a link you may be sent in an email or text message as a simple way of protecting yourself.

Also be wary of giving information to someone over the phone who claims to be calling from your super fund. Instead, hang up and call your super fund directly to be certain of the legitimacy of the call. Scammers often have some information about you already, so they can be convincing when they make contact.

A typical red flag is someone trying to get you to take a quick action on the spot. If you receive an approach where you feel pressured to take action by email, text or automated voicemail; it's important to cease any communication and seek advice from a family member or other trusted source before taking the next step.

For more information and advice on superannuation scams, see our blog post about keeping your personal and financial data safe online during COVID-19 or visit www.scamwatch.gov.au

COVID-19 Update: Wednesday 6th May

After the events we’ve had to endure so far in 2020, we could all be forgiven for suggesting that we’ve had enough crises to keep us occupied for the next decade. Having said that, there appears to be a momentum shift, as people prepare themselves for a cautious re-opening and return to ‘normal’. How we disentangle ourselves from this temporary global shut-down that’s been forced upon us, is going to be a bit of an experiment.

The road to recovery

There is still uncertainty about how the re-opening will unfold, but what is certain is that the road back is likely to be a slow and volatile journey for investors. Expect some phasing across the economy: staged return to work, re-opening of shops and a return of weekend and other social activities, all of course with an element of social distancing. The control of mini-virus breakouts, possibility of isolating neighbourhoods, spectator-less sport and other major events, as well as global travel to be limited to 3-hour flights to NZ if we’re lucky (although the Kiwis may not think that!) will become more typical. We may also find a similar rhetoric to that in the UK where different age groups possibly face a longer journey back to norm.

Counting the costs

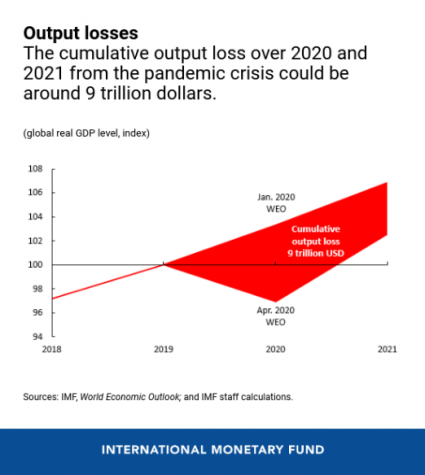

Even though peak virus growth may be behind us, the economic fallout from COVID-19 is still yet to peak. Some of the figures now start to boggle the mind. 30 million newly unemployed people in the USA. Oil prices at -US$40 (yes, that’s a minus sign in front of that number). Air traffic dropping 97% into Sydney Airport. As the chart below shows, the IMF, who are dubbing this “The Great Lockdown”, project lost economic output across 2020 and 2021 at US$9 trillion (that’s a nine in front with twelve zeroes after it) - equal to the annual output of Japan and Germany combined.

While the magnitude of the above data is quite unbelievable, investment markets and more specifically equity markets seek to look through these challenges to understand how businesses and economies will perform in the years ahead. The positives are that several economies are now starting to ease out of hibernation and Government and central bank efforts to appease markets and inject enough money and liquidity into economies seems to be giving some confidence.

What investors can expect

Despite this, forward looking indicators show that the worst is not yet behind us. Some sectors especially in small and medium enterprises (non-listed entities) can only look ahead a month or two in a battle to survive, while bigger business will survive but may exit The Great Lockdown changed. We need to expect that economic data isn’t likely to bottom until June or possibly even later.

So the dramatic headlines will continue for some time. All of this means the road back from The Great Lockdown is likely to be a slow and volatile journey for investors.

The dividend dilemma

To get through the period ahead, companies are reviewing their dividend and profit outlooks.

Many have taken a very cautious approach by withdrawing earnings guidance for the time being. There is also a growing number that will not pay a dividend in the period from now through to September and possibly longer depending on the timing of the recovery. This has implications for any investor with a diversified portfolio and more specifically equity portfolios.

The decision to cut dividends is in the long term a prudent one, essentially aimed at preserving as much cash as possible so that businesses have funds available to return to full operating capacity in the months and years ahead. Shareholders should expect a dividend recovery once companies become more confident that the worst of the virus is behind them and activity is returning to pre-virus levels. Interestingly, the impact is uneven, with some of the traditionally higher risk sectors including miners and some discretionary retailers in sound capital positions and traditionally defensive companies such as toll roads and airports experiencing reduced demand, --significantly impacting cash flow.

Banks in a sound position

We’re fortunate that lessons from the global financial crisis mean that our banks are well positioned to withstand an economic shock. The Big 4 (Commbank, Westpac, NAB and ANZ) were all in the top 10 banks globally for capital positions heading into this shutdown, but they will still be significantly impacted. APRA, who regulate the banks, has stated that they need to carefully assess current and future conditions that may transpire and consider their dividend and capital positions. This has already led to a reduction or deferral of the current period dividend (usually paid in late June/ early July for three of the big four). The most important outcome for the banks will be getting business activity moving again, although the major banks should come through okay and be in a position to help the economy on the road to recover.

Active portfolio management

It’s likely that portfolio income for those with equity exposure, will be reduced for at least the next 3-6 months. In the main, with very low interest rates and the likelihood of further dividend cuts or postponements, portfolio income will be lower for the remainder of 2020 and possibly into the 6-12-month period thereafter. Looking over the medium to longer-term (3-5 years or more), you would expect many businesses to be able to pay higher dividends than today.

Of course, the length of any income reduction and the period to recovery will depend on the nature of the turnaround once businesses can re-open and people eventually get back to normal. But rest assured we will be actively managing portfolio positioning to minimise the reduction of income.

Ripple effect of early release of superannuation

Recently the ABC were reporting that some $4 billion of super has been paid out to those seeking early access to $10,000 of their retirement savings. Some experts estimate that this could rise to $30-50 billion, which if true, means around 2 million people will end up withdrawing money early from superannuation.

From an individual’s perspective, accessing super early is a relatively simple equation; access super now to get through an incredibly difficult time, offset by a future reduction in retirement savings or income.

But the broader impact of all these withdrawals on financial markets is worth considering. The bulk of these withdrawals are coming from industry funds which have historically been blessed with seemingly never-ending positive cash flows making capital allocating a relatively easy task; and where more illiquid risks could be taken as the money was not expected to be needed for many years.

These early release withdrawals are likely to soak up cash flows for some time and as a result, these funds won’t be allocating out as much capital. This has the potential to be a drag on the Australian share market over the next 6-12 months and if early withdrawal opportunities were to become a more regular event, industry super funds may have to set more money aside for early withdrawals which is likely to mean they generate lower returns for their members longer-term.

FMD update

Our team has settled into the work from home routine and are getting used to a different work environment, with far less commute times!

We’re proud to say that our advisers have proactively reached out to over 1,200 of our clients in the past six weeks, with the aim to reach all of you in the not too distant future. We thank you for the conversations you’ve shared with us.

Some of these conversations have been challenging; discussions around selling investment portfolios to ‘lower risk’ positions or cash, but when thinking about investing, we strongly believe maintaining a diversified investment exposure tailored to each person’s risk profile is the most successful over the longer-term. Selling after markets drop or trying to pick the lows before adding in new money are strategies that are impossible to execute successfully.

This was the case following the GFC, with investors who sold to cash still sitting in there many years after, missing a robust share market recovery. This will also be the case for the unadvised investors who panicked and changed their investment mix after the March decline this year. They have already missed a 20% rally in the ASX.

History demonstrates that including risky assets is the best long-term wealth strategy, both for accumulating assets and also generating sound returns for the long-term of retirement.

Regular review meetings

Our path back to normal office operations will be based on guidance from federal and state sources but in the meantime, we’re keeping our usual ‘face-to-face’ review meeting routine running, albeit in a different format.

If your review is due in the coming weeks (and possibly months) you should expect to have a virtual meeting option via our preferred ‘app’ Microsoft Teams. When you are due for your review, look out for an invite with a link and also some instructions to help you out prior to the meeting. We will look to work with each of you to provide you with an experience you are comfortable with when its required.

We’ve also sought to deliver information to you in new mediums, including video, and we’re about to trial some podcasts along with some light-hearted communication, as many of you have some added time to pass now. Let us know what works for you and look out for further updates as they come to hand.

As always, we wish you and your families health, wealth and happiness and for a speedy but safe return to normal life in the period ahead.

COVID-19 Update: Friday 24th April

Richard Dahl, FMD Investment Committee Chair, and Mike Reynolds, Director and member of the Investment Committee, have come together with FMD CEO, Lee Wapling, to provide a video update on the current state of the market in response to the spread of COVID-19.

In the discussion, Richard and Mike provide their insights into the impact of COVID-19 on the financial markets, review what's happened to date and give an update on what actions FMD has taken and how our portfolios have responded. They also address questions such as why this crisis is different, what might happen next and whether there are any silver linings in the current or future situation.

To view the video please click on the following link: COVID-19: FMD Investment Committee Update

COVID-19 Update: Monday 20th April

Superannuation: Temporary Early Access

In March 2020, the Federal Government announced early access to superannuation as one of their measures to support people experiencing financial hardship during the COVID-19 pandemic. The Australian Government has published a Fact Sheet with more complete information, including eligibility criteria and how to apply, but some of the more important details of this temporary measure to ease financial hardship include:

- From Monday 20 April, eligible Australians will be able to access up to $20,000 from their super fund/s

- If you meet the financial hardship criteria, you can apply for $10,000 before 30 June 2020 and a further $10,000 after 1 July 2020.

- Early withdrawal is available to people who are unemployed, have had their working hours/business income reduced by 20% since 1 January 2020 or are receiving Centrelink payments.

FMD encourages you to seek advice before considering this course of action. While we recognise that these funds could represent welcome cash during a time of financial stress, withdrawing from your super fund has the potential to make a significant difference to your level of income in retirement.

The table below indicates the projected balance reductions arising from a combined $20,000 withdrawal now:

|

Age at withdrawal |

Projected superannuation balance reduction |

Estimated impact on retirement income per month |

|

30 |

$50,000 |

$216 |

|

40 |

$39,000 |

$166 |

|

50 |

$30,000 |

$130 |

|

60 |

$24,000 |

$104 |

While the ultimate impact will depend on unknown factors, such as the future rate of investment earnings on your super, withdrawing from your super now can only reduce savings at retirement which means less income in retirement. More immediately however, for those with low super balances insurance needs should be considered as early access may leave insufficient savings to continue paying for insurance premiums in super.

Before progressing with early access to superannuation, consider other avenues such as speaking to your bank, utility providers, landlord and other service providers to see what relief and options are available first.

Also, if you have children or relatives that have found themselves on the back end of the economic downturn, it may be worth discussing with them the options they have and what would be the best long-term course of action for them. Other avenues as noted above, may be worth exploring further before seeing super as an accessible source of cash to pay for today’s commitments.

We're here to help

If you require early access to superannuation, we are here to help. We encourage you to contact your FMD Adviser at your earliest convenience to understand your options and to discuss your requirements.

COVID-19 Update: Thursday 16th April

As we highlighted in our COVID-19 Update: Wednesday 25 March, scammers continue to take advantage of the uncertainty amid the COVID-19 crisis and now, are specifically seeking to take advantage of the Australian Government’s Household Stimulus Package. We have had reports from our clients about callers claiming to be from Centrelink requesting bank account details so they can arrange for payment of the $750 stimulus package.

FMD would like to reiterate the need to be careful not to give any personal details to unsolicited callers and to be wary of emails or text messages claiming to be from experts. For more information about scams, how to make a report and where to get help, visit: www.scamwatch.gov.au/news

COVID-19 Update: Thursday 9th April

With a very different Easter weekend almost upon us, the Federal Government's historic $130 billion JobKeeper bill passed parliament with bipartisan support late last night.

The aim of the scheme is to keep employees linked to their employer until a return to more normal operations when social distancing restrictions are eventually lifted. As of yesterday, 750,000 businesses had already signed up for the scheme and that number is expected to grow.

The Australian dollar strengthened on the news, trading at 62.2 US cents overnight. The government will be hoping it has done enough to stem the tide of unemployment, though the financial resilience of businesses and families will continue to be tested. Never before has good financial advice been so important to help people face the challenges ahead and we remain committed to supporting our clients and staff through this difficult time.

Centrelink

As you may expect, the demand for support from Centrelink has grown exponentially in the past month as businesses have gone into hibernation and newly unemployed Australians seek government assistance.

This demand has impacted Centrelink response times for those seeking to newly apply for the Age Pension and also those who have sought to update any personal or asset details with Centrelink.

Until the past few days, we had been helping clients update their individual circumstances with Centrelink with mixed results. To speed this up we have been working closely with platform providers like Asgard, HUB and Netwealth to have them update asset values with Centrelink on your behalf.

Thankfully, this process will be simplified, with the platforms now able to send data in bulk to Centrelink. Some directly held assets will still need to be updated manually and we will assist where we can.

As asset values are now more likely to be lower (based on share market and other asset price movements) this valuation update may lead to a higher Age Pension entitlement. If this impacts you, you should receive confirmation from Centrelink in coming weeks but as ever, please reach out to your adviser with any queries.

After a challenging few weeks for us all, from the entire FMD community, we wish you and your family a safe and restful Easter.

COVID-19 Update: Friday 3rd April

We’re now all getting used to what is quite a different life - and world - than we’ve been accustomed to. Self-isolation and social distancing are new but very familiar terms. And someone walking through a supermarket wearing a face mask (if you are fortunate to venture out for some milk…or toilet paper) is no-longer an unusual sight. The learning curve we’ve all been on following this forced change has been momentous; showing us the significant adaptability and resilience of humans.

The magnitude of information (noise) relating to COVID-19 that is flowing around has increased exponentially as we try to come to terms with what is going to be a challenging period to navigate. As you know at FMD we encourage our clients to ignore the noise and focus on the long term, so in this update we will try to summarise rather than add to the noise.

The Health Situation

Primarily this remains a health crisis and while we are not experts in this area, we note that unfortunately there are rising numbers of COVID-19 cases in many parts of the world and a corresponding rise in fatalities. Some silver lining for the time being, is that isolation and distancing measures appear to be slowing the spread of the virus in a range of countries, if acted on early enough, which Australia and many other countries appear to have managed to do.

The Economic Situation

The economic impact from this crisis has been dissected from every angle. We have been juggling email inboxes full of investment updates providing different perspectives, none of which provide a panacea. However, summarising the most balanced views, the two key areas to focus on are:

- How long economies remain effectively shut down, which will depend on the health situation, primarily seeing a noticeable reduction in the spread of the virus; and

- Government and policy maker responses to support economic activity.

The first point above is still very much uncertain. We know governments are trying a range of tactics to stem the spread. How long these measures will be in place for and their ultimate impact remain unknowns, but we must take confidence that vital actions are taking place. Our own Prime Minister Scott Morrison has remarked that we should prepare for at least six-months of these conditions; something that may be truer than we all hope for.

Policy response around the world has been unprecedented in its scope and depth and as a result investment markets have been starting to settle after a period in March that was the most volatile in history.

Job Keeper Package

The most significant policy response in Australia since our last update is the JobKeeper Package for businesses and self-employed, where the Government will pay $1,500 per fortnight to support the retention of employees for businesses where revenues have been impacted by the downturn. This measure alone, is expected to cost the government $130bn. Other new measures include wage subsidies for trainees and efforts to keep child-care services operating.

Hibernation is fast becoming the norm. Allowing a fully functioning business, with employees, lenders (banks), suppliers, owners, profits, etc. to essentially stop for an uncertain period, is a massive experiment that has never been attempted before. For some businesses the pause will mean they will not survive. For others, they may be able to stumble through relatively unscathed. It will be mixed.

While not all of the policy measures will be perfect, the magnitude of the stimulus (in the order of $320bn from Treasury) and efforts by the Reserve Bank of Australia (ensuring low interest rates and that banks can continue to lend) to support businesses, individuals and the financial system are the ‘bazookas’ necessary and show a preparedness of policy makers to act quickly and with conviction in Australia – something other nations may look to follow.

FMD’s Portfolio positioning

Even with this, and possibly more support, we expect equity markets to remain volatile in the period ahead whilst there is uncertainty relating to the virus. Until the spread looks to be under control, markets will not truly be able to begin to consider what a recovery, following a mass global shut-down, may look like.

We are taking steps to ensure all our investment managers have fully reassessed their portfolios and that their investment approaches remain relevant in a period of economic hibernation.

Reassessing revenue, profit and dividend risks is something our equity managers are focused on. While our fixed interest managers are moving towards less risky sectors or borrowers.

We believe the range of managers you have exposure to are relatively well placed so we do not foresee significant changes for portfolios in the short-term, however we continue to closely watch equity, bond and currency markets for any opportunities or risks and will advise to make changes where we see either.

We further emphasise the value of diversification in uncertain times and maintaining exposure to a range of different asset classes, investment styles and fund managers that should enable you to ride through bouts of volatility that are likely to continue.

Actions you can take

Register for MyGov

One action we would encourage you to undertake today, if you haven’t already, is to register with MyGov (www.my.gov.au). The MyGov site allows you to access a range of Australian Government services, including the ATO, Centrelink, Medicare and your personal health records.

It is the most effective way to update any of your personal circumstances for age pension, income or other support purposes and while you may not be eligible for benefits today, things are changing rapidly and the chances of contacting Centrelink via phone (should you be eligible) is near impossible at present.

Pensioners

If you haven’t already done so, reassessing your income requirements is worth considering given we can’t spend as much due to being largely home bound. One policy adjustment provided by the Government is the halving of the required minimum you must draw from your account-based pension for this and next financial year.

FMD’s own operations update

To date, the transition to working from home has been relatively seamless. We thank you all for your understanding if you have found it a little more challenging to reach us, as we all come to terms with the change we’ve been forced into. For those of you that have your FMD Review Meeting in the coming months, if you would like to have a video conference rather than a phone call, we encourage you to explore downloading Skype or Zoom on your mobile, tablet or laptop/PC. We can assist you with that at the time, if needed.

Conclusion

Please remember that having a good network around you providing emotional support is incredibly important as social isolation shows us just how much we require human to human interaction – even if it is as simple as a phone call. . As financial advisers, we’re here to help you feel as confident as you possibly can with what you wish to achieve financially, especially in periods of uncertainty like this.

COVID-19 Update: Tuesday 1st April

Life insurance companies resond to the COVID-19 outbreak

The Financial Services Council (FSC) have moved to reassure life insurance policy-holders that they will be covered for claims relating to Coronavirus.

All life insurance companies issuing policies in Australia subscribe to the FSC Code of Practice. According to the FSC, all subscribers to the code have confirmed there are no exclusions in their existing life insurance policies as at 11 March 2020 that would prevent the policy paying out for a death claim related to coronavirus, provided you follow Government travel advice.

If you have taken out new life cover since 11 March 2020 or are thinking of doing so, your adviser can help you understand whether there may be any policy exclusions or modifications related to COVID-19 which would depend on your specific circumstances.

We may see more headlines around this topic, but it's important to remember that insurance companies can only make changes that impact new policies and are fully disclosed at the time of underwriting. If you have any queries or concerns about your existing insurance arrangements, please contact your adviser.

COVID-19 Update: Friday 27th March

Contacting us as we work from home

We hope you and your families are safe and as comfortable as possible in these uncertain times.

To prioritise the safety of our teams following the escalation of the COVID-19 situation, all FMD Teams are now working from home. While we are well prepared to do this with minimal disruption, it is not quite business as usual and we have some suggestions to make it easier to contact us.

As always, your Adviser will be your first point of contact and the best way to contact them at present is via email and, if you want to chat, they’ll call you back as soon as possible.

However, you can also use the following numbers for assistance:

FMD Adelaide: 0429 467 154

FMD Brisbane: (07) 3852 1966

FMD Melbourne: (03) 9620 4633

In the Melbourne office, our receptionists Sophie and Suzi are continuing to manage phone calls but this may not be as seamless as normal. As a back-up, if you cannot get through, our receptionists have temporary mobile phones that will be monitored for messages throughout business hours. Phone 0429 326 055 and 0429 329 933.

Client meetings

We will continue to hold client meetings as scheduled, although these will be via telephone or video conferencing tools like Skype and Zoom.

FMD is continually monitoring the current climate and will respond where necessary to enact the relevant steps in our Business Continuity Plan. We will continue to communicate updates that are relevant to your needs via email and on our website.

The health and safety of our clients, our staff and our community are our priority and we thank you for continuing to work with us to minimise the risk of COVID-19. Please note these details for future reference and do not hesitate to contact us if you have any questions or concerns.

COVID-19 Update: Wednesday 25th March

Scammers taking advantage of uncertainty amid COVID-19 crisis

FMD has talked about scammers before, including what to watch out for and how to protect yourself.

Sadly, times of fear and uncertainty provide a great opportunity for scammers to target people at their most stressed and vulnerable. From selling false Coronavirus-related products online to phishing for personal details by impersonating legitimate organisations, scammers have been quick to capitalise on confusion created by the rapidly changing circumstances all Australians now face.

The ACCC's Scamwatch has already received 94 reports of Coronavirus-related scams and expect that number to rise. Since the Federal Government announced measures to allow people to access their superannuation in recent days, scammers have been impersonating superfunds in calls and emails asking Australians to confirm their super account details.

CEO of the Association of Superannuation Funds of Australia, Dr Martin Fahey, took to the media to urge people to be careful not to give any personal details to unsolicited callers and reiterated that superfunds won't be contacting consumers directly relating to this measure. He urged people to be wary of emails or text messages claiming to be from experts.

FMD recommends that for the most up-to-date information about the Coronavirus, visit the Department of Health or the World Health Organisation websites directly.

For more information on scams and how to make a report and where to get help, visit www.scamwatch.gov.au/news.

COVID-19 Update: Monday 23rd March

What the latest stimulus relief package could mean for you

The Australian Government continues to announce measures to support Australians and the economy in response to COVID-19. Following on from our last update, outlined below is a summary of the most relevant measures announced.

Superannuation - Income stream drawdown rates

To avoid unnecessary selling of investments while markets are low, there will be a temporary 50% reduction to the drawdown rates you’re required to withdraw from your superannuation pension account. These reductions will apply for the rest of this financial year and for the 2020/21 financial year.

| Minimum pension payments | ||

|---|---|---|

| Age | Current | New |

|

Less than 65 |

4% |

2% |

|

65-74 |

5% |

2.5% |

|

75-79 |

6% |

3% |

|

80-84 |

7% |

3.5% |

|

85-89 |

9% |

4.5% |

|

90-94 |

11% |

5.5% |

|

95 + |

14% |

7% |

Action to take: Clients with adequate cash reserves may benefit from reducing their superannuation pension payments. Please speak to your adviser if this applies to you.

Reduction in deeming rates for Centrelink Recipients

For clients who have a Centrelink benefits and are ‘income tested’ a further reduction in deeming rates was announced on 22 March. The deeming rates will reduce as follows:

| Current | From 1 May 2020 | |

| Lower deeming rate | 1.0% | 0.25% |

| Upper deeming | 3.0% | 2.25% |

The deeming thresholds are unchanged at $51,800 (single) and $86,200 (couple) which are generally indexed on 1 July each year. The rates will take effect from 1 May 2020, and any additional entitlement will be paid from 1 May 2020.

Action to Take: No action required.

Centrelink Assets Test

As noted previously, for those who are ‘asset tested’ for Age Pension or Disability Support Pension purposes, given the selloff in the share market over the last month, you may find that once Centrelink reassess the value of your assets (shares, account-based pensions etc.) your Age Pension entitlements may increase.

Access to super

Access to superannuation savings will be broadened where you’re in financial distress because of the Coronavirus. If you’re eligible you’ll be able to access up to $10,000 before 30 June 2020 and an additional $10,000 from 1 July for approximately three months.

To be eligible, you must meet one of the following conditions:

- you’re unemployed

- you’re eligible to receive Jobseeker Payment, Youth Allowance (jobseekers), Parenting Payment, Special Benefit or Farm Household Allowance

- on or after 1 January 2020, you were made redundant, your hours of work reduced by at least 20%, or if you’re a sole trader, your business was suspended or your turnover reduced by at least 20%.

Applications will be through MyGov from mid-April. and you’ll need to certify that you meet one of the above eligibility requirements. Payments will be tax-free and amounts received will not impact Centrelink or DVA entitlements.

Stimulus Payments - 2 x $750 cash payments

Now two payments of $750 each will be paid to eligible income support recipients and concession card holders. As outlined in our earlier communications, the first tax-free payment will be available to eligible income support recipients as at 12 March 2020 and is expected to be automatically paid to eligible recipients from 31 March 2020.

The second payment will be available to those who aren’t eligible for the Coronavirus supplement (see below) and will be automatically paid from 13 July 2020.

Coronavirus Supplement

The Coronavirus supplement of $550 per fortnight will be paid to new and existing recipients of:

- JobSeeker Payment

- Youth Allowance (Jobseeker)

- Parenting Payment

- Farm Household Allowance, and

- Special Benefit.

The supplement will be paid over the next six months and will be paid automatically with the person’s ordinary fortnightly entitlement. It will be paid from 27 April.

Fast tracking benefit payments

If you apply for a social security benefit or concession card and your claim is related to COVID-19, some of the ordinary eligibility rules and waiting period rules may be waived. The assets test will also not be applied when determining entitlement to JobSeeker Payment, Youth Allowance (Jobseeker) and Parenting Payment for six months. The income test will continue to apply.

Note that Centrelink were already overwhelmed by the bushfire response, so new applicants are being encouraged to claim online via MyGov wherever possible. While you can make phone claims the wait times are horrendous.

Mortgage repayment freeze

While banks are prepared to offer repayment pauses during this period, the loan repayment will be capitalised, so this isn’t ideal unless there is significant financial distress, so please speak with your adviser.

Business investment

A series of initiatives for business investment have been developed including:

- Banks to provide payment deferral for eligible small business loans.

- Coronavirus Guarantee Scheme where the Government will guarantee 50% of the value of new loans.

- Additional lump sum payments of between $20,000 and $100,000 to assist with operating expenses of employers in small to medium sized businesses and not-for-profit organisations.

- Instant asset write-off threshold increased from $30,000 to $150,000 and broadened to cover businesses with an annual turnover of up to $500 million for the current financial year (up from $50 million.)

- Accelerated depreciation of 50% will apply to eligible assets until 30 June 2021 to businesses with an aggregated turnover of less than $500 million

- Employers with apprentices and trainees can apply for a subsidy of 50% of the employee’s wage.

Measures to support small to medium businesses are comprehensive and ongoing, so please visit https://treasury.gov.au/coronavirus/businesses for the latest detailed information.

Other measures

Additional measures announced include:

- Support for regions and communities impacted by the virus with reliance on tourism, agriculture and education

- Administrative relief provided by the ATO for certain tax obligations, such as lodging tax returns and activity statements, which will be assessed based on individual circumstances, and

- Comprehensive health package of $2.4 billion.

You may wish to contact the ATO's Emergency Support Infoline on 1800 806 218 or visit their COVID-19 web page.

To find out more about these and any other issues or concerns you may have, please contact your FMD adviser.

COVID-19 Update: Wednesday 18th March

The Australian Government’s response to COVID-19

In addition to the wide-ranging community health initiatives implemented in relation to COVID-19, the Australian Government has also announced further economic responses totalling $17.6 billion. To protect the economy by maintaining confidence, supporting investment and keeping people in jobs, we expect that there will be ongoing measures and initiatives announced as the implications of the spread of the virus become evident.

At the time of writing, the Government’s economic response was targeted at four key areas:

- Delivering support for business investment

- Cash flow assistance for employers

- Stimulus payments to households to support growth

- Assistance for severely affected regions

Below is a summary of the initiatives that may have the most significance to you, our clients.

Stimulus payments to households to support growth

The main measure for individuals is a one-off payment of $750 to pensioners and welfare recipients such as those on Newstart. To be eligible, you must be residing in Australia and be receiving income support payments or hold a concession card on 12 March 2020, including Pensioner Concession Card, Commonwealth Seniors Health Card, Veteran Gold Card.

The one-off payment will be paid automatically from 31 March 2020 by Services Australia or the Department of Veterans’ Affairs. Over 90 per cent of payments will be made by mid-April 2020.

Centrelink Income Test – reduction in Deeming rates

On 12 March 2020 the Government announced changes to the deeming rates (the rate of income Centrelink deem to be received from certain assets like your cash, shares, managed funds to generate).

The lower rate dropped to 0.5% (from 1%) and the upper rate dropped to 2.5% (from 3%).

The proposed deeming rates are summarised in the following table:

| Proposed Deeming Rate | Single Pensioner | Pensioner Couple (Combined)# |

|---|---|---|

| 0.5% | First $51,800 ($259) | First $86,200 ($431) |

| 2.5% | Excess | Excess |

# At least one member receives a pension.

For those receiving the Age Pension or Disability Support Pension, if you are currently ‘income tested’ this could lead to an increase in your Age Pension entitlements.

Centrelink Assets Test

It is also worth noting that for those who are ‘asset tested’ for Age Pension or Disability Support Pension purposes, given the selloff in the share market over the last month, you may find that once Centrelink reassess the value of your assets (shares, account-based pensions etc.) your Age Pension entitlements may increase.

Support for businesses

For those running small businesses there is added incentive to spend with an increase in the instant asset write-off, while cash flow assistance will also be provided aiming to help businesses retain employees.

For more information on the Australian Government response to COVID-19 visit the Department of Health website at www.health.gov.au or https://www.pm.gov.au/media/economic-stimulus-package.

FMD will be keeping a close eye on any further developments but if you have any questions in the meantime, please feel free to contact your adviser for more information.

COVID-19 Update: Monday 16th March

We hope everyone in our community is managing through the current situation as best they can. Below is the latest information on how we are continuing to monitor the implications of COVID-19 for all our clients and staff.

Our key priorities are:

- the health of our clients and staff;

- providing continuity of management for your financial affairs; and

- maintaining the quality of our service delivery.

While our team has not been directly impacted by the virus, it is not quite business as usual and we have made a few changes based on the latest Australian Government and World Health Organisation advice.

Onsite measures:

- We are in the process of rescheduling all client meetings to telephone or video conference for the foreseeable future.

- If staff show any symptoms, they are required to self-quarantine.

- We have implemented enhanced hygiene procedures to limit the spread of the virus.

- Non-essential travel has been restricted.

- We have postponed or cancelled all imminent client and external events.

Service continuity:

- Clients can continue to contact their adviser at any time over the phone or via email.

- Meetings can take place via Skype, Zoom, Microsoft Teams or on the phone.

- FMD advisers and staff all have remote access and can continue to work securely and productively from offsite locations.

- The FMD Investment Committee and your adviser will still be able to enact all client portfolio transactions as per normal.

These are unsettling times, but FMD remains in an extremely strong position to support our clients and manage their investments with the continuity, calm and rigour they expect. This is an evolving situation that we will continue to monitor and keep our clients informed of any material changes.

In the meantime, if you would like to discuss any of the above in more detail, please do not hesitate to contact your adviser.

COVID-19 Update: Friday 13th March

As we anticipated, markets have exhibited more volatility in the past week with ongoing concerns relating to Coronavirus shutdowns, exacerbated by a tiff between Russia and Saudi Arabia in the oil market.

The cancellation of some events and disruption to travel plans looks to be the next phase for the Coronavirus issues, which is unsettling and will impact economic activity, but it won’t last forever.

Of course, we understand that substantial negative moves in equity markets can be difficult to endure, but the impact on FMD portfolios is lessened by our focus on diversification. Our clients' portfolios will generally include cash, fixed interest, property and other assets that are not as volatile as the equity markets are currently.

So we strongly encourage keeping a level head and maintaining diversified portfolio positions. Reacting to the negativity by selling is something we advise against but anyone concerned should reach out to their adviser.

Some positives

Governments are beginning to step in and provide stimulus, while central banks are likely to revisit interest rates to provide further support. Both measures aim to ensure money keeps flowing to consumers and companies as business activity slows. Once the virus spread moderates, we’re confident that business activity will resume, and markets will return to more rational behaviour.

Most retirees shouldn’t see too much impact to income flows at this stage, as cashflows from most companies and investments are expected to be maintained. For larger cash requirements which would require an investment sell down, it may be worth pausing on that spend for the time being.

However, for those with money to deploy, there will be some opportunities to invest into high-quality investments ahead.

In summary

We reiterate that for investors, maintaining broad diversification and exposure to high quality assets is important. The FMD Investment Committee (IC) is meeting more regularly to ensure our investment positioning remains appropriate. At this stage minor changes are being considered; however, no changes will be finalised until signs of volatility ease.

FMD’s own plans for managing COVID-19

From a client service perspective, FMD has plans in place to ensure business continuity in case of an office closure or an extended lock-down. If you have a face to face meeting booked with us, we look forward to welcoming you to our office, but we can hold meetings over the phone or via video conference if you would prefer. Please rest assured your adviser and our entire team will remain accessible via email or phone throughout the period ahead, in case you do need to make contact.

COVID-19 Update: Friday 6th March

Investment Implications

Markets took their time to digest what investment implications there may be relating to the outbreak of the Coronavirus. Until this past week, there was optimism that it would be effectively constrained to the originating source in mainland China. Now that we are seeing increasing cases throughout the world, market optimism has swiftly disappeared and turned to fear.

Media coverage

The headlines seem frightful, which is the media doing a good job of catastrophising the situation. There will be negative growth consequences and real impacts to company earnings, and while the depth and breadth are hard to judge currently, it could be expected to have a short duration and thereafter, activity should return to its previous path.

From an infection point of view, we are not qualified to comment on the spread and likely control of the virus; much of this still seems uncertain even for the experts to confirm. As such, uncertainty is prevailing, which is an investment market's greatest fear. Yet, one could expect, once the spread of the virus slows and the worst moves beyond us, that activity will return to prior levels, and possibly quickly. It's unlikely that demand will slow too much for goods and services that we all rely on, much of which is reliant on Chinese supply chains, that are the most impacted by enforced shutdowns to control the virus’ spread. The further flow on effects are now what investment markets are grappling with and we’re seeing a swift change in investor sentiment to a much more risk-averse position.

In these periods, risky investments that can be liquidated quickly are the most negatively affected. It’s a challenge that some investors can’t cope with and they begin to follow the herd and sell as well. Markets are resilient, as are humans ultimately, and joining the herd and selling at these times is, in our view, one of the last things that is worth pursuing.

Valuation

From a valuation (or fundamental) perspective, equities weren’t cheap heading into this uncertainty. At the same time, defensive assets were also expensive. High quality bonds, US currency and in some cases, gold are sought after assets and are seeing strong demand in this ‘risk-off’ period. Defensive assets are now becoming even more expensive which could create different issues once equity volatility settles. While market corrections are difficult to sit through, it puts markets on a more sustainable path in the longer-term.

Trying to find the right time to exit and the right time to enter any investment market is incredibly difficult and should be done with caution. Generally, where investors hold well diversified portfolios of quality assets you should remain fully invested and avoid alarmist newspaper headlines and try not to check your account balances on a regular basis.

Near-term outlook

Frankly we expect to see bad economic data and company updates in the weeks and months ahead given the measures taken to control the virus’ spread - locking people down in their homes for days has obvious impacts on production and spending. We could finally see a technical recession in Australia for the first time in 30-odd years. Companies will provide market updates in the foreseeable future which will acknowledge the spread and negative impacts the slow activity is having.

What we do know, is that there will be a point that new infection rates will slow and activity will resume. In fact, we’re already seeing some of this through China, where road traffic is returning, and business as usual is restarting. Also, to assist the recovery, once government focus moves from containment to returning to normal, if the recovery remains sluggish, we could expect central banks and governments to try to stimulate growth. This will occur via interest rate cuts or providing incentives to get people spending again. In one of the worst affected zones, Hong Kong, “helicopter money” (cash handouts) is already occurring. In other locations, interest rates can still be cut, including in Australia and the US.

FMD Positioning

Through the latter part of 2019, FMD’s Investment Committee made some adjustments to investment portfolios, adding more defensive assets to reduce some equity market risk given the strong market performance last year. In some cases, gold was also added. We've also been keeping our portfolios broadly diversified seeking returns from a range of different asset classes and investment styles. We remain confident in this approach and believe this will assist portfolios in being able to weather the worst of the uncertainty that is upon us.

We advise investors to remain calm but aware of the current heightened concern in markets. Now, as always, is a time to remain focused on looking through uncertainty and volatility, remain focused on what is in your control and ignore the noise.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.