What keeps people awake at night in the lead up to retirement?

The Financial Planning Association of Australia (FPA) recently partnered with Fidelity International to conduct research to measure the benefits and value of working with a professional financial adviser.

The FPA research found the same five critical questions are keeping retirees awake at night:

- How much do I really need?

- Am I on track?

- What are my options?

- How much should I be saving today?

- What can I afford to spend in retirement?

FMD advisers can use modelling tools to help you understand the answer to each of these questions in your own personal circumstances.

The confidence this knowledge brings is typically well worth the advice fees associated with the initial statement of advice. While the advice implemented on their behalf often compounds to deliver a significant financial returns over many years, as many of our clients have experienced first hand.

The tangible benefits of having the right financial adviser

The findings show what our team at FMD have always known: Australians with an active relationship with a financial adviser are better off in four important ways:

- They suffer less financial stress,

- They enjoy a higher quality of life,

- They have more financial confidence and;

- They are more satisfied with their wealth.

We like to think of them as the four gifts of financial advice that keep on giving for our client community, many of whom were initially referred to us by another FMD client who spread the word.

How hard is to find a good adviser?

The FPA research found that demand for advice continues to outstrip supply, as the younger cohort of baby boomers, some 3.6 Million Australians, approach retirement. As our industry continues to professionalise, the number of advisers has fallen by more than 40%.

The good news for people still looking for the right financial coach, is that advisers like ours are more qualified and experienced than ever, but finding one with the capacity to take on new clients can be tricky.

Our team has the experience and capability to take on new clients and with most advisers spending more than 10 years with FMD, you can be confident they'll be there to support you throughout your retirement journey,

When should people start planning for retirement?

The sooner people start planning for retirement, the better. The FPA research found the runway to retirement can be shorter than expected.

Older Australians often intend to work longer, with the average age of planned retirement being 65, but one in three people surveyed retired earlier than planned. The top three issues leading to early retirement are:

- Suffering from personal health issues,

- Caring for somebody suffering ill health or;

- Unexpected redundancy or job loss.

The below chart shows how average retirement ages have changed over the last 50 years. While the average age is trending higher again, great advances in life expectancy mean retirees need to plan for 15-20 years of living beyond retirement perhaps longer if retirement comes earlier than planned.

How does planning for retirement help?

The FPA research also found that compared with semi-retirees and early retirees, pre-retirees report the highest level of financial stress. Sadly, 50% of this cohort worry about money monthly, while 30% face daily financial worries.

We consistently receive feedback from our clients that removing financial worry is one of the greatest benefits of their relationship with their FMD adviser.

A close second is having some control over your financial future. Major life changes like the transition to retirement can be stressful, but feeling in control of when you can afford to stop working and how much you need to live the lifestyle you want in retirement, are powerful ways to care for your mental health during this time of upheaval - and are among the greatest gifts of professional advice.

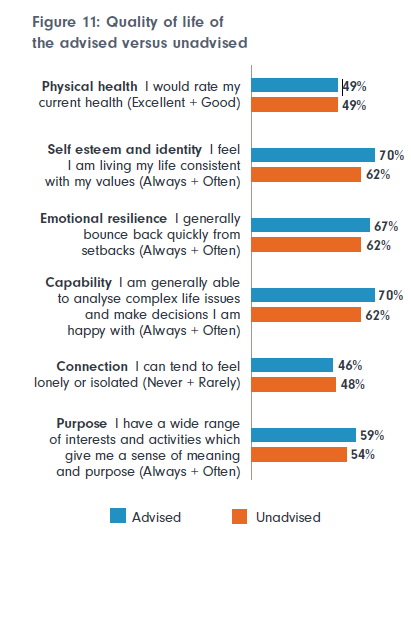

This chart from the FPA research shows on every measure of quality of life, Australians who have an active relationship with a financial adviser fair better. With so many people needing professional advice and so many benefits from receiving it, why not consider booking a confidential chat with an adviser today? Because the thing we hear most after a first meeting is "I wish I’d done this years ago."

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.