Economic Snapshot: Mixed performance on equity markets

The RBA raised the cash rate by 25 basis points to 4.1% in early June, the second increase since April.

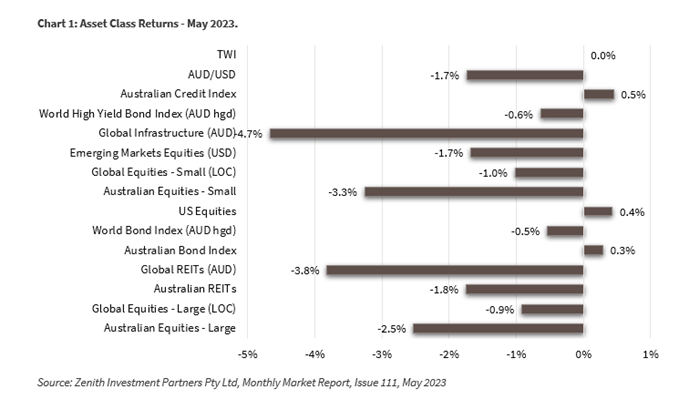

Global equity markets had a mixed performance in May, with Japanese equities performing well while European and UK markets gave up some recent gains.

The Australian equity market underperformed global equities, declining 2.5% in the month, mainly due to banks and materials facing recession risk and weaker commodities prices.

A lack of IT exposure in the Australian market also held the market back when compared to global markets.

Global and Australian bond yields increased in May due to reassessments of the outlook for interest rates, driven by inflation data and comments from central bank officials.

Global Developed Equities

In May, global equity markets had a mixed performance. Japanese equities performed well, while European and UK markets faced setbacks.

The US S&P500 traded within a narrow range, with mega-cap stocks continuing to rally, offsetting weaknesses elsewhere. Rising interest rates were driven by uncertainty over the US debt ceiling and continued concerns about inflation.

The MSCI World ex-Australia index declined by 0.9% in May, reducing the year-to-date return to 8.8%. A decline in the Australian dollar meant a 1.2% rise in the global market index in AUD terms.

Certain mega-cap stocks (including Apple, Meta Platforms and Amazon), particularly in the US, have been the main driver of the year-to-date return of the S&P500.

Factors such as artificial intelligence and perceived safe-haven status contributed to their strong performance. At the same time, cyclical stocks performed well, while defensive and value stocks faced headwinds. The global manufacturing sector is showing signs of slowing but service sectors remained solid.

Inflation risks persist, with higher-than-expected core inflation in the US and the UK. Central banks may still need to address these risks, leading to expectations of further interest rate hikes in the months ahead.

The US debt ceiling issue was resolved through an agreement between Democrats and Republicans, avoiding a default.

Australian Equities

The Australian equity market had a challenging month, declining by 2.5% and resulting in a year-to-date gain of 2.7%, much lower than global equities.The materials sector declined by 4.4%, banks by 4%, and consumer staples were also weaker.

Weaker global demand and China's underwhelming recovery led to a 14% decline in commodity prices, with iron ore down by 15%.

The Reserve Bank of Australia (RBA) surprisingly increased the cash rate to 3.85% in early May. RBA Governor Philip Lowe mentioned the need to control inflation, which remained high at 7% despite passing its peak. The decision to raise rates was driven by the importance of bringing inflation back within the RBA’s target range.

The Australian Government Budget showed a surplus for the first time since 2007-08, reflecting improved fiscal conditions due to higher employment, and commodity prices.

Inflation was higher than expected at 6.8%, indicating the possibility of further rate adjustments by the RBA. Rising house prices and a recent wage increase decision may complicate the RBA's efforts to control inflation.

Consumer confidence and business confidence remained subdued, with renewed concerns about interest rates impacting sentiment. Australian bond yields rose from 3.35% to 3.61%, posing additional challenges for equity valuations.

Emerging Markets

The MSCI Emerging Markets index declined 1.7% in May, with Chinese equities dragging down the performance.

The Chinese economy's rebound has been slower than expected, with low PMI, weak retail sales, and industrial output. However, real estate prices have recovered, and the government is focusing on consumption rather than real estate for growth.

Emerging markets face challenges from high global interest rates, a strong USD, and investor concerns about Chinese equities. China's growth, though below expectations, is still better than developed economies, with low inflation and accommodative monetary policy. India's growth remains strong.

Property and Infrastructure

Australian Real Estate Investment Trusts (AREITs) declined by 1.75% in the month following a 5.3% rise in April and have seen a year-to-date gain of 4%.

Global REITs also faced challenges in May, declining 3.8% and a loss of 1.8% for the year due to deteriorating commercial real estate valuations. The global infrastructure sector dropped by 4.7% in May, leading to a 3.1% loss in 2023.

Rising real yields and falling commercial real estate values contributed to the challenges faced by the property and infrastructure sectors.

Australian valuations showed evidence of a 10% decline in certain property sectors, while industrial property performed well. In the US, commercial property values have experienced a more significant decline, impacting the performance of Global REITs.

Fixed Interest – Global & Australia

Global bond yields increased in May as investors reassessed the outlook for interest rates, particularly in the US. The US 10-year yield reached a high of 3.83% before easing to 3.64% at month-end.

There were mixed inflation readings, with prices rising in the US and the UK. Global bonds returned -0.5% for the month.

In Australia, bond yields also rose due to higher-than-expected inflation and a strong job market. The RBA surprised the market with another interest rate hike, bringing the cash rate to 3.85%.

This was driven by concerns about rising inflation and labour costs. Australian bond returns were negative, and inflation-linked bonds performed well.

It's important to note that rising interest rates may impact consumer spending and housing affordability. Business confidence and consumer sentiment have weakened. However, NAB business conditions remain solid.

Overall, global and Australian fixed interest markets experienced upward pressure on yields, reflecting expectations of higher interest rates due to inflation concerns.

Commodities & Currencies

Commodity prices faced weakness in May due to concerns over a potential recession and disappointing Chinese data. Copper and Brent crude oil prices declined by 6.5% and 8.1% respectively.

The underwhelming Chinese industrial recovery also impacted iron ore prices, which dropped by 4.8%. On the other hand, gold performed better, losing 0.8%.

The RBA commodity price index experienced a 6.9% decline in the month and has fallen by 13.5% year-to-date, and over 22% over the past 12 months.

In terms of currency, the USD strengthened as expectations for higher Fed funds rates increased, leading to a decline in the AUD.The AUD ended the month at 65 cents, down from 66.2 cents earlier in the month.

Overall, concerns about the global economic outlook, particularly regarding Chinese growth and commodity markets, contributed to weakness in commodity prices.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by FMD Group and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the the information contained in this document. Advice is required before any content can be applied at a personal level. No responsibility is accepted by FMD Group or its officers. Past performance is not an indication of future performance.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.