Economic Snapshot: Markets react to mixed data

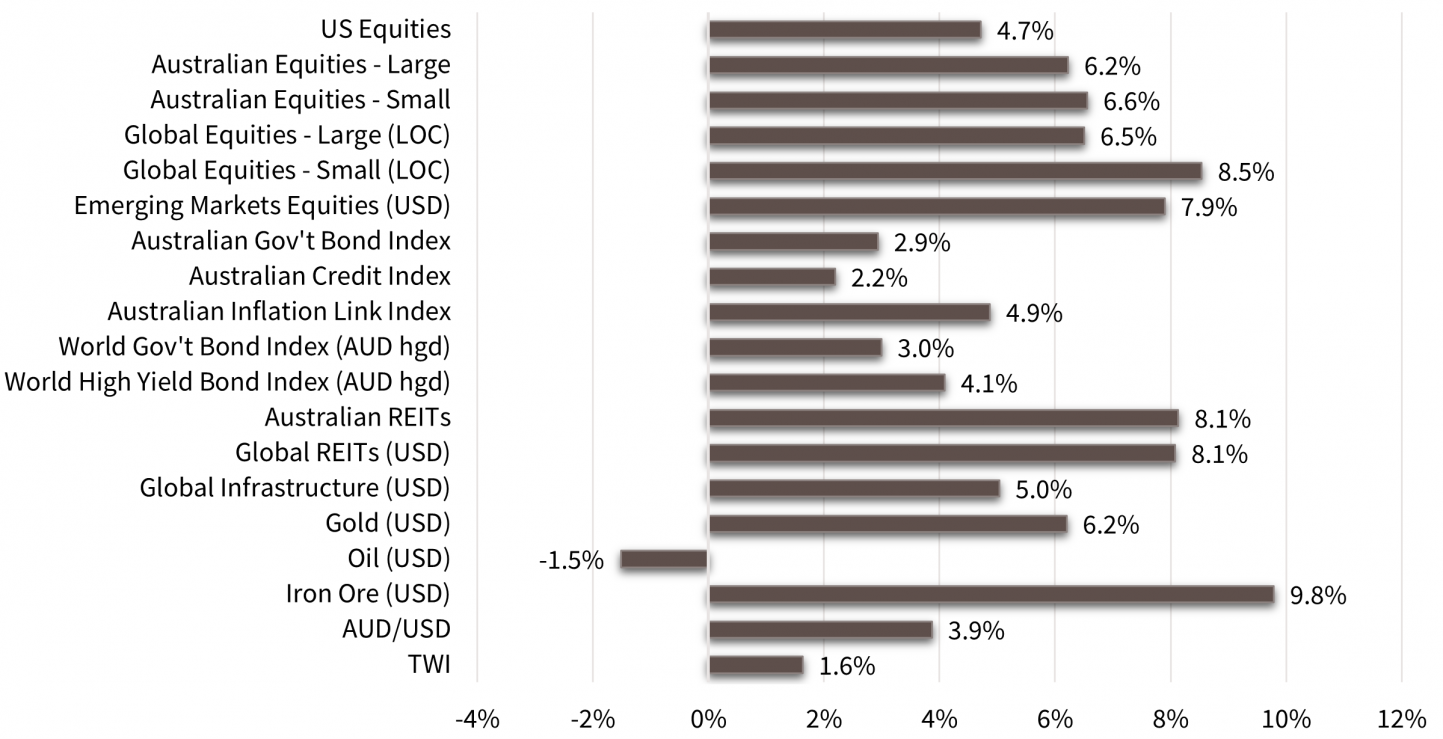

Financial markets started the year on an upbeat note, with rallies across the board in January.

The driver of this optimism was a widespread expectation that the worst has passed in the inflation cycle and that this means central banks are just about done with lifting interest rates. More than this, the markets believe that as economies slow and unemployment rates rise under the impact of monetary tightening, so the central banks will start to backtrack and cut rates.

However, the economic data remain mixed. Importantly, while inflation appears to have peaked in the US, the labour market remains very tight. The Fed has a clear goal of rebalancing supply and demand in the US labour market in order to cement a lower inflation regime.

This may lead to a harder landing for the US economy than the markets currently hope for.

Chart 1: Markets rallied well in January on hopes that central bank rate hikes are nearly over.

Source: Thomson Reuters, Bloomberg, 1 February 2023

Financial Markets

Financial markets started the year on an upbeat note, with rallies across the board in January. Government bond yields, both nominal and inflation-protected, fell around 30-50 basis points.

That in turn pushed yield curves further into inversion territory – a sign of slowing economic growth. Credit and high yield spreads narrowed in the US but widened in Japan and the UK.

US bond markets implied inflation eased further. Equity markets staged decent rallies as lower bond yields helped support higher P/E ratios. Sectors such as small caps and REITs, which had underperformed last year, recovered some ground. The US$ slipped further and the A$/US$ pushed above US$0.70 for the first time since August 2022.

Interest Rates

The driver of this optimism was a widespread expectation that the worst has passed in the inflation cycle and that this means central banks are just about done with lifting interest rates. For example, the markets think the RBA will lift the cash rate to around 3.50% - 3.75% by Q3 this year, and that the Federal Reserve will lift their cash rate to nearly 5% by mid-year.

More than this, the markets believe that as economies slow and unemployment rates rise under the impact of monetary tightening, so the central banks will start to backtrack and cut rates. The markets expect only a very moderate 0.25% cut from the RBA around the end of the year, but in the US, they expect the cash rate to fall by 2% from late this year through 2024. This is despite the Fed saying they have no plans to cut the cash rate until well into 2024 and that will depend on how inflation behaves.

Market Expectations

This difference in apparent expectations between the Fed and the markets is a key risk for both bonds and equities in coming months.

If the Fed is forced to move towards the markets, then January’s rally may be able to continue. However, if the markets have to shift their views into line with the Fed, then the January rally is more likely to unwind. It all depends on what happens with inflation and unemployment as the year unfolds. Inflation will fall and unemployment will rise, but the relative pace matters.

As long as inflation falls broadly in line with expectations, then the faster the unemployment rate goes up, so the markets will expect the central banks to cut sooner rather than later.

Other things equal, that should be good for the markets. However, the big question remaining is how much damage is done to the economy along the way? And what does that mean in turn for profit growth and equity markets? At the moment, it seems generally accepted that the US and UK will have recessions this year, as will parts of Europe, but that Australia is well placed to do better than that.

What we do not know is how deep and how long any recession may be. Markets know the recent rally has made equities more expensive and that there are questions around how much profit downgrades have already been priced. The start of the US company earnings season in recent days has been more encouraging than might have been expected but coming weeks will paint a more complete picture.

Economic Indicators

In the meantime, the latest economic data continue to present a mixed picture. In the US, there were more signs of the economy slowing down. GDP growth is nearly zero, the ISM manufacturing index fell for the fifth month in a row, housing market activity has fallen sharply, and consumer spending is slowing.

However, the unemployment rate is still at historically low levels around 3.5%, unemployment benefit claims remain very low, another 223,000 jobs were added in December and job openings are still nearly twice the level as job hires.

Inflation

On the inflation front, supply chain pressures continue to ease, and CPI inflation eased in December. Headline CPI was 6.42% over the year to December after 7.12% in the year to November. The corresponding figures for core inflation were 5.69% and 5.96%.

Australia

At home, our markets were surprised by a 3.9% drop in retail sales in December, with clothing, footwear and department store sales among the biggest contributors to the result. Both household and business confidence improved slightly in December, but business conditions softened.

Although employment fell slightly in December, the labour market remains tight, with the unemployment rate steady at 3.5%. Overall, the impact of interest rate rises to date is yet to clearly show up in the growth data.

The December quarter CPI results exceeded expectations, but not by much. Headline inflation was 1.9% in the quarter and 7.8% over the year to the quarter. The latter figure was the highest in nearly 33 years. Core inflation was 1.74% in the quarter and 6.9% over the year. Markets read the data as supporting further interest rate increases by the RBA, but, on a brighter note, still see the December quarter as the peak of this inflation cycle.

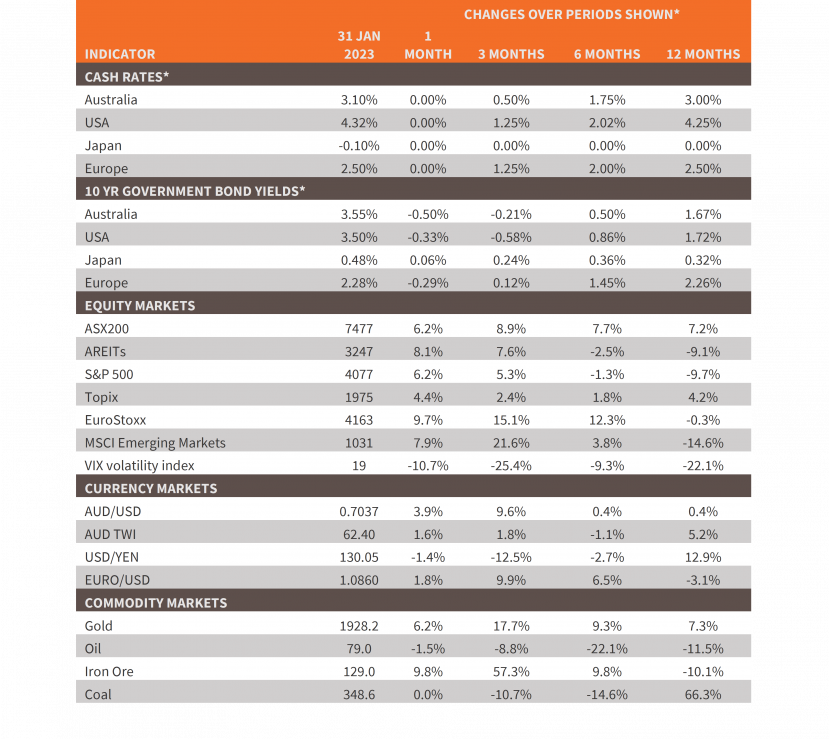

Chart 2: Major Market Indicators – January 2023

*For cash rates and bonds, the changes are percentage differences; for the rest of the table percentage changes are used.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.