Economic Snapshot: 2023 Market Roundup

In its final meeting of 2023, the Reserve Bank of Australia Board left the cash rate unchanged at 4.35% despite concerns that inflation could remain above the 2 to 3 % target "for a prolonged period".

Global Equities jumped a further 1.8% in AUD terms, taking the quarterly gain to 5.3 %, driven by an apparent “pivot” in interest rate policy guidance from the Federal Reserve and an ongoing decline in bond yields.

After lagging markets for much of the year, Australian stocks rebounded sharply in December, rising 7.3% to close at record levels. In terms of sectors, REITs (listed property) led the charge, rising 11.4% in the month, while Healthcare also performed strongly, up 9.1% in December.

Australian bond yields followed global bond yields lower with the 10-year yields dropping below 4% on lower inflation and the prospect of an imminent easing cycle.

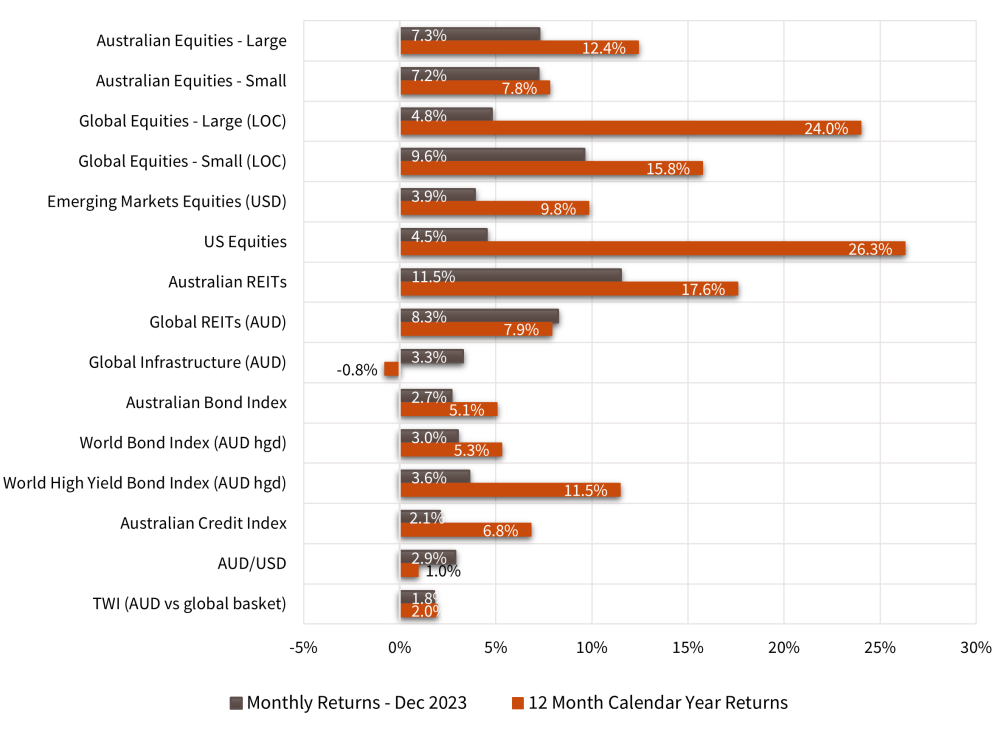

Asset Class Returns - December Monthly and Full Calendar Year Returns 2023

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 118, December 2023

Global Developed Equities

Equity markets finished the year strongly, with the global market up 24%.

The MSCI World ex Australia index rose 4.8% in the month and was up 11.3% for the quarter, the best since 2020. The market thrived due to a resilient global economy, strong corporate earnings, and lower-than-expected inflation.

The Federal Reserve signalled a likely end to the hiking cycle, projecting rate cuts to 4.6% by end of 2024 and 3.6% by 2025. Markets anticipated rate cuts, with bond yields dropping to below 3.9%.

Inflation news was positive, with the US at 3.2% in November and core PCE (personal consumption expenditure – inflation relevant for consumers in the USA) at 1.9% in the last six months. US economic growth was 5.2% in Q3, while Europe teetered on technical recession.

REITs, construction materials, and IT sectors performed well. Cyclicals, growth, quality, and momentum stocks rose over 12%, while defensives and value lagged for the quarter and year.

Australian Equities

Australian stocks made a strong comeback in December, surging 7.3% to near-record levels. However, the annual gain of 12.4% lagged global markets by over 10%. This rebound was driven by increased confidence in the end of the interest rate hiking cycle, lower bond yields, and higher price-to-earnings multiples.

Unlike the US, investors are more cautious about rate cuts in Australia due to delayed inflation and wage growth, with a subdued earnings outlook of approximately 2% expected for the next 12 months.

In its last 2023 meeting, the RBA agreed to hold the cash rate at 4.35%, although there were comments expressing concerns about prolonged inflation, above the Bank’s 2-3% target. The decision was based on the need for more data to assess evolving risks, despite positive signs of progress. Inflation eased to 4.9% in October.

Economic data for the September quarter revealed stagnant growth, impacted by weak consumer spending due to higher interest rates and tax payments. GDP per capita remained negative for the third consecutive quarter. The NAB business survey indicated lower confidence and declining forward orders.

Notable sector performances included REITs rising 11.4% in December, healthcare up 9.1%, and financials, after a slow year, gaining 6.2% in December and 8.2% for the quarter.

Emerging Markets

Emerging markets saw a 3.9% rise in December (+1.8% in AUD terms) but trailed behind global developed and domestic equities for the quarter, with a 7.9% increase (2% in AUD terms).

Chinese equity market struggles, influenced by concerns over their property sector, limited policy stimulus, and the demand for a higher risk premium, led to a 4.2% drop in the quarter and an 11.2% annual loss. However, positive economic data on retail sales and production emerged toward year-end.

Excluding China, many emerging markets performed well. Latin America, led by Brazil and Peru, gained 8.3% in the month, 17.6% for the quarter, and 32.7% annually. Europe rose 12.9% in the quarter and almost 30% for the year, driven by Hungary and Poland's 50% increase.

Despite being relatively inexpensive compared to developed markets, emerging markets need a catalyst for outperformance. Some central banks (Brazil, Hungary, Poland) are easing policy, and recent USD weakness is favourable. The potential for a global cycle turning could further boost emerging markets.

Property and Infrastructure

Real Estate Investment Trusts (REITs) and infrastructure faced challenges from rising real yields in 2023.

However, a significant bond rally in November-December led to a rebound, with Australian-REITs rising 11.4% in December, achieving a quarterly gain of 16.5%, equalling the entire 2023 increase.

Global REITs also saw an 8.3% December increase, resulting in a 12.7% quarterly advance. The FTSE Global Infrastructure index rose 3.3%, following a 6.7% gain in November.

Lower real yields played a crucial role in these improvements. Despite this, infrastructure was among the few asset classes to end the year with a negative return.

Fixed Interest – Global

US bond yields fell from 5% in October to below 3.9% by year-end due to lower inflation and expected Federal Reserve interest rate easing. Market expectations implied a Fed funds rate cut as early as March 2024, with projections of six 25 basis point cuts in 2024 to 3.8% and an additional 100 basis points to 2.85% by early 2026.

The December Federal Open Market Committee (FOMC) meeting signalled the end of the hiking cycle and a likely soft (economic) landing (no, or shallow, recession).

The Barclays Global Aggregate index (a global broad-based fixed interest benchmark) returned 3%, essentially the entire 2023 return. Inflation in the US dropped to 3.2%, with core PCE at 1.9%, at the policy-makers target.

High yield spreads narrowed, reflecting confidence in a soft landing, with the Barclays Credit index returning 3.6% for the month and 8.5% for the quarter.

Fixed Interest – Australia

Australian bond yields closed the year at 3.97%, down from October's peak of 4.95%.

The Bloomberg Composite bond index returned 3.8% for the quarter and 5.1% for 2023. In its last 2023 meeting, the RBA kept the cash rate at 4.35%, expressing concerns about prolonged inflation above the 2-3% target.

The RBA signalled a pause in rate hikes, with markets expecting a cut by September 2024, projecting Australian rates slightly above US fed funds by early 2025. Lagging inflation and wages growth compared to the US supported the Australian dollar.

Economic challenges persisted, as the NAB business survey indicated declining forward orders and subdued business confidence. The September quarter GDP data showed the Australian economy grew by 0.2% (2.1% for the year), with consumer spending unchanged.

On a per capita basis, consumption declined by -2.0%, reflecting household pressure from interest costs and tax payments. Despite tight labour markets, the unemployment rate stood at 3.7%.

Commodities

In the December quarter, commodity prices, excluding oil, increased. Brent crude fell 7% to US$77.10 a barrel due to elevated US supply and OPEC+ members exceeding production quotas amid the Israel-Hamas conflict.

Copper and iron ore rose, reaching US$142.50 a tonne. Gold surged over 11% in the quarter and 13% for the year, benefiting from Fed easing projections and a weaker USD.

Currencies

The AUD, initially under pressure, ended the year above 68 (US) cents, influenced by revised Federal Reserve funds expectations and a comparatively less dovish RBA cash rate outlook.

The euro rose 4.4% to 1.104, the pound increased 4.4% to 1.273, and the yen depreciated by 8% to just above 141 to the USD in 2023, following the Bank of Japan's maintained yield curve control policy.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.