Economic Snapshot: Markets take a step back as inflation falls

July’s CPI result was 4.9%, slowing from 5.4% in June, which cemented expectations of a pause in interest rates. The Reserve Bank of Australia (RBA) delivered, choosing not to raise interest rates in August, keeping the cash rate at 4.1%.

Global equities fell by 2.3% after two months of strong gains, driven by rising bond yields indicating a better-than-expected economy.

The Australian stock market lost 0.7% for the month, underperforming global markets. Banks and materials sectors declined, while retailers gained nearly 10%, possibly due to hopes of a halt in rate hikes.

Australian bond yields dipped slightly, while global bond yields continued to rise, reflecting expectations of prolonged higher rates in the US and greater sensitivity of Australian households to short-term interest rates.

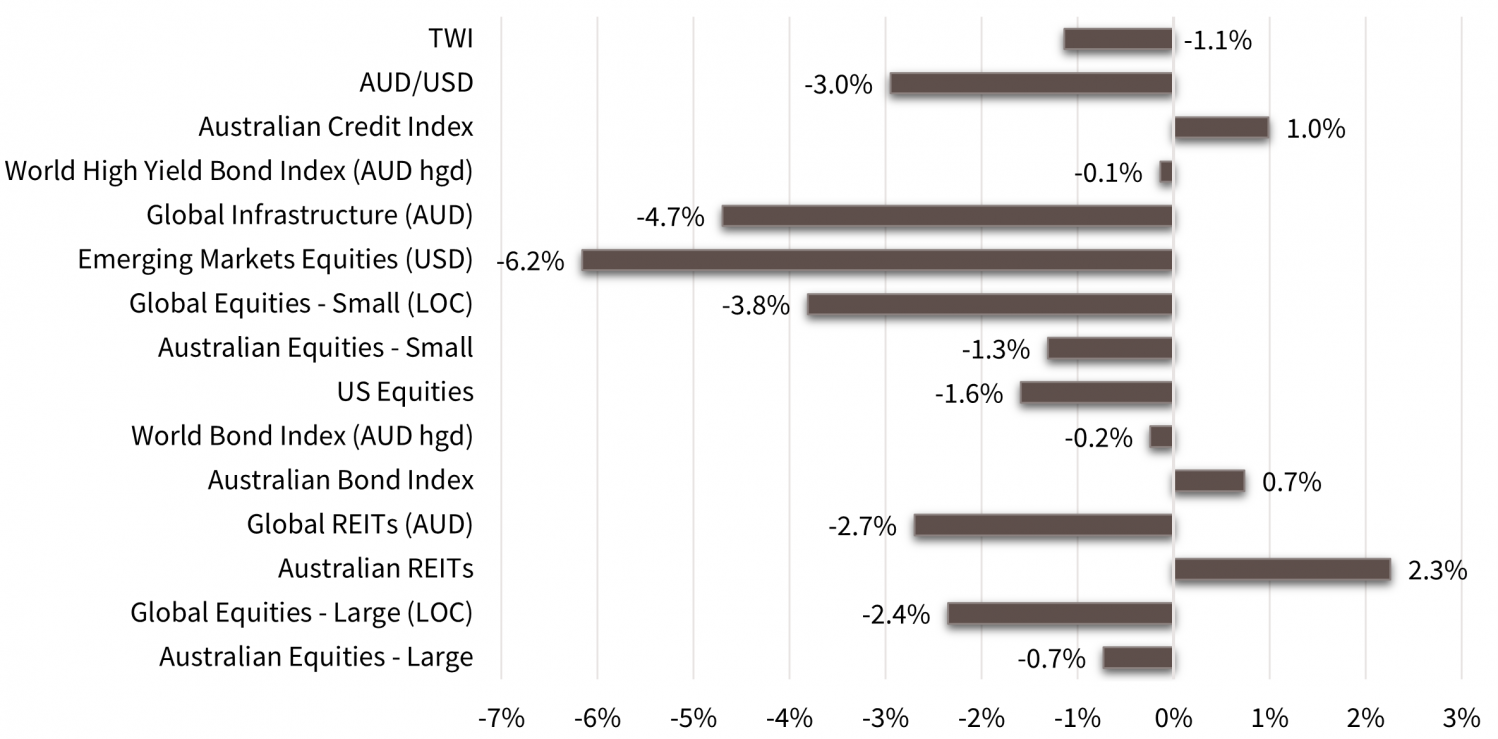

Asset Class Returns - August 2023

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 113, July 2023

Global Developed Equities

In August, global stock markets dropped 2.3%, following two months of strong gains. However, for the year so far, they're up 16.4% in US dollar (USD) terms, or 21.9% in Australian dollar (AUD) terms due to a falling Australian dollar. The S&P 500 experienced a 5% dip in mid-August due to rising bond yields, particularly real yields.

This was driven by the US 10-year bond yield increasing to 4.34% before settling lower after a more dovish tone from the Federal Reserve, reduced expectations of US rate rise. The rise in real yields suggested an improving economy while inflation remained low, influencing longer-term bond yields and Price Earnings (PE) multiples.

US earnings declined by 4.1% over the year, but consensus estimates anticipate nearly 12% growth in Earnings Per Share (EPS) in 2024 as the earnings cycle stabilises. However, this growth projection conflicts with expectations of ongoing economic challenges due to relatively higher interest rates.

In Europe, economic growth disappointed, and inflation remained above European Central Bank targets, with Germany's economy struggling due to weak manufacturing.

The US market performed best, although down 1.7%, while Japan and Europe ex-UK were down 2.4% and 4% in August, respectively. Year-to-date gains were 18.7% for the US, 13.6% for Japan, and 13.9% for Europe.

Quality stocks outperformed, only dropping 1%, while Value and cyclical stocks were down 2.8% and 2.7%. IT, construction materials, communications, and retailing sectors showed positive performance for the year, up at least 28%, while banks were the worst performers, down 6.7%.

Australian Equities

In August, the Australian stock market declined by 0.7%, bringing the year-to-date gain to 6.7%, which is lower than global equities.

The banking sector dropped by 0.8%, while concerns about Chinese growth led to a 2% decrease in the materials sector. Retailers, however, gained nearly 10%, possibly due to optimism that the interest rate hikes are coming to an end. Real estate investment trusts (REITs) rose by 2.3%.

The Reserve Bank of Australia (RBA) decided not to raise interest rates in August, citing the need for more time to assess the impact of recent rate hikes. Lower-than-expected inflation in June played a role in this decision, with the RBA reducing its end-2023 inflation forecast to 4.1%. The July inflation data further reinforced the view that interest rates will remain steady.

Additionally, wage growth for the June quarter was slightly below expectations, supporting the case for a pause in tightening monetary policy. Wages increased by 0.8% in the quarter, with an annual rate of 3.6%. July's employment data also showed softer numbers, with 14,600 jobs lost and the unemployment rate rising to 3.7%.

During the June reporting season, companies generally exceeded lowered expectations, but concerns about rising costs and a challenging consumer outlook were widespread. Consensus estimates anticipate a small decline in earnings in the coming year.

Emerging Markets

In August, emerging markets saw a decline of 6.2% in USD terms, bringing the year-to-date gain to only 4.6%, significantly trailing behind developed markets. In Australian dollars, emerging markets were down 2.4% for the month.

The Chinese equity market, which had rebounded in July due to expected policy stimulus, experienced a 9% loss in August as the measures announced fell short of expectations. These measures included interest rate cuts, reduced foreign currency reserves for banks, and steps to support the property and household sectors.

Korea and Taiwan declined by 7.6% and 4.5%, respectively, reflecting global trade challenges and weaker demand for semiconductors outside AI-related products. India fared better, but overall, the MSCI Emerging Markets Asia Index dropped by 6.2%, and Latin America fell by 7.3%, led by an 8.3% decline in Brazil.

Economic data showed weak forward looking Purchasing Managers Index (PMI) readings in China's manufacturing and service sectors, mild deflation in consumer prices, and a significant decline in producer prices. Brazil and India saw improved PMI readings, while South Korea and Taiwan faced soft economic activity.

Property and Infrastructure

Australian REITs had a good month, gaining 2.3% in August and reaching a solid 10.4% return for the year, outperforming the broader stock market. This is surprising given concerns about property values and rising real yields. In contrast, global REITs declined by 0.2% in the month, with a year-to-date gain of just 1.2%, mainly due to higher US real yields and ongoing property valuation concerns.

The rise in real yields has also negatively impacted infrastructure investments. In Australia, the 10-year inflation-linked yield reached 1.82% in mid-August, while in the US, 10-year Treasury Inflation-Protected Securities (TIPS) yields hit 2%, the highest since 2009. Global infrastructure investments fell by 4.7% in the month and are down 4.6% for the year.

Fixed Interest – Global & Australia

Global bond yields increased in August, with the US 10-year yield reaching 4.34% before ending the month at 4.1%. This rise was mainly due to a surge in real yields, while inflation expectations remained stable at around 2.25%. Fitch Ratings downgraded the US government's rating to double-A plus, citing increasing debt and governance concerns.

Despite weak survey data, actual consumer and business spending remained strong in the US, leading to debates about the neutral interest rate. US CPI rose to 3.2% in August, but measures of sticky price inflation fell, supporting the view of a "soft landing."

Eurozone inflation was at 5.3%, with core inflation easing. The UK saw high wage growth at 7.9%, requiring continued restrictive policies.

Global bonds had a -0.2% return for the month and 1.8% year-to-date, with confidence in avoiding a recession keeping credit spreads relatively low.

Australian bond yields ended the month slightly down at 4.02% despite rising US yields. As noted above, the RBA chose not to raise rates, given the impact of recent rate hikes and lower-than-expected inflation. Job losses and a rising unemployment rate in July were observed, but business conditions did not signal a recession.

Overall, global and Australian bond markets responded to rising yields and central bank decisions, with a focus on potential inflation outcomes and economic conditions.

Commodities

In August, commodity prices had mixed results. Brent crude oil rose to $86.85 a barrel due to OPEC production curbs, and further increases followed news of Saudi Arabia and Russia reducing oil output. Iron ore prices increased by nearly 6% to $117.5 a tonne, despite concerns about China's property sector. Copper, however, dropped 3% and remained flat for the year. Gold prices decreased to $1,942.3 an ounce as real yields rose.

The RBA's commodity price index fell 2.3% in August and has dropped over 20% for the year.

Currencies

In August, the USD gained 1.5% due to expectations of a "soft-landing" and prolonged low Fed interest rates. The euro fell over 1% to 1.08 USD, the yen dropped over 2% due to low Japanese interest rates, and the pound declined despite strong wages and high inflation. The AUD saw a 3.6% drop to 64 cents against the USD, driven by negative carry, falling commodity prices, and worries about the Chinese economy.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.