Economic Snapshot: Investor sentiment turns

Investor sentiment turned in September with inflation data suggesting there were risks of further interest rate hikes ahead to cool ongoing consumer price pressures. This impacted many asset classes and is likely to see markets remain nervous as they anticipate the next move by central banks.

The RBA agreed to keep the cash rate at 4.1% at the September meeting, Philip Lowe’s last meeting as governor, although he noted the possibility of further tightening should inflation remain high.

Global equity markets declined 4% in September, taking the September quarter loss to 0.4% following a strong first half of the year. For the quarter, the bank sector managed to rise 4.4% while energy was up more than 11% and insurance 1%. However, REITs, materials and IT were all weaker.

The Australian equity market lost 2.8% in the month, and -0.8% for the quarter. In line with global markets, the bank sector managed to rise 4.4% while energy was up more than 11% for the quarter. Similarly, Real Estate Investment Trusts (REITs), materials and information technology were all softer.

Global and Australian bond yields surged in September on the back of a better-than-expected economic data, even in the face of substantial interest rate increases since March 2022.

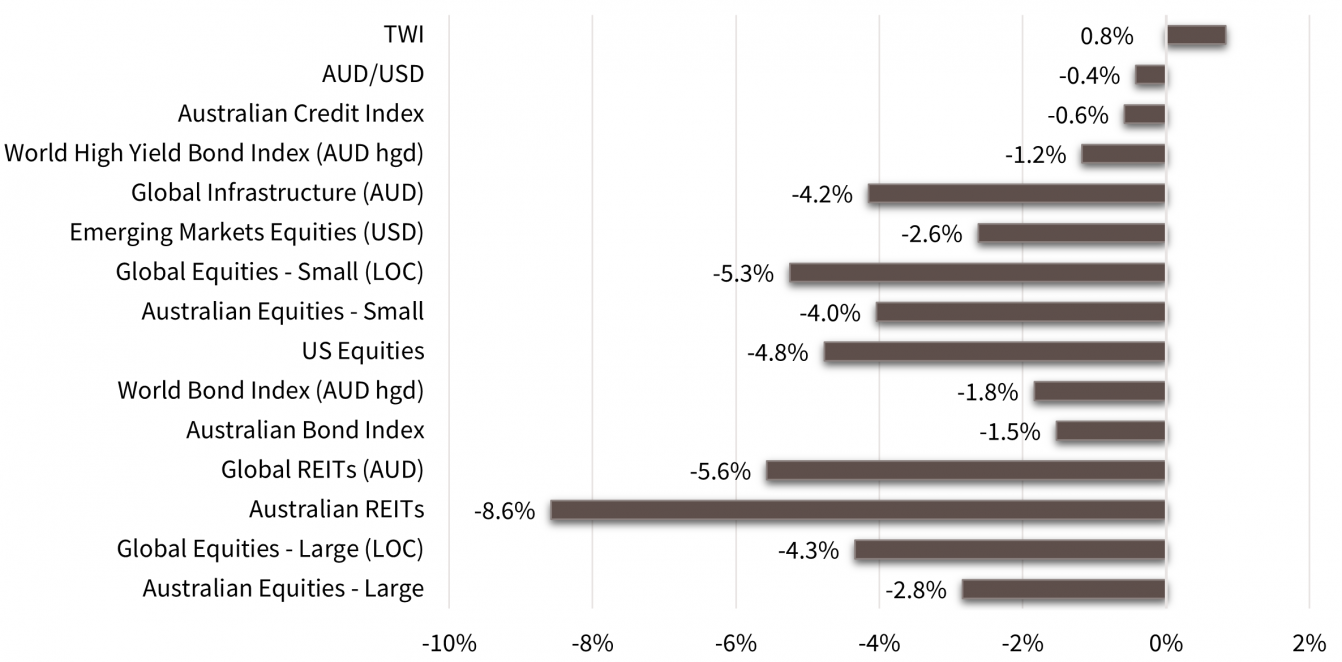

Asset Class Returns - September 2023

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 115, August 2023

Global developed equities

In September, global stock markets dropped by 4.3%, contributing to a quarterly loss of 3.5% due to rising bond yields, particularly in the US.

The strong US economy, despite hiking rates by 5.25% since March 2022, initially boosted market confidence. However, attention shifted to projections of prolonged higher interest rates, affecting market valuations.

Despite a decrease in inflation, the Federal Reserve increased its 2024 interest rate estimate to 5.1%. The United States faced challenges from a doubled fiscal deficit and concerns about government shutdowns, impacting bond markets.

Earnings outlook remained positive at 10%, indicating potential growth, supported by robust consumer spending. Inflation varied globally, with the United Kingdom experiencing 6% and Japan maintaining a 3% level.

Among regions, the UK performed best (-0.8%), while Europe (-4.9%) and the US (-4.7%) experienced larger declines. Value stocks outperformed due to rising interest rates.

Energy sector showed positive performance, while REITs, consumer discretionary, and IT sectors declined over 5%. Norway's market saw gains due to rising oil prices, while Italy, Ireland, and Spain lead the year's performance.

Australian Equities

The Australian stock market also fell by 2.8% in September and was up by 3.7% for the year, lagging global markets.

Higher bond yields and reduced PE multiples affected markets, similar to the global trend. Unlike the US, Australia's earnings outlook is weak with an expected -2% EPS growth in the next year.

The banking sector rose by 4.4% for the quarter, while energy increased by over 11% and insurance by 1%.

The Reserve Bank of Australia (RBA) did not raise rates in September, but market pricing suggests a potential increase to 4.35% before the end of the year. Inflation rose to 5.2% for the year, with core inflation at 5.5%. The RBA is monitoring the impact of previous interest rate hikes before making further decisions.

Emerging Markets

Emerging markets dropped by 2.6% in USD terms and 2.3% in AUD terms over the month. China's poor performance, driven by issues in its property sector, COVID-19 recovery challenges, and policy uncertainty, significantly impacted emerging markets.

Chinese stocks now trade at a substantial discount, with a Price to Earnings multiple below 10, a 40% reduction compared to global markets since the late 1990s.

Korea and Taiwan faced over 6% declines, while India showed a 2.7% rise in the quarter.

The outlook for emerging markets is closely related to US interest rates and the USD. If US rates stabilize and markets anticipate any easing, the challenges for emerging markets might lessen.

Property & Infrastructure

Rising real yields negatively impacted REITs and infrastructure sectors throughout September. REITs, already expecting property value drops, fell sharply by 8.6%, and infrastructure dropped by 4.2% globally.

These declines were due to a significant increase in US 10-year Treasury Inflation Protected Securities (TIPs) yields, affecting valuations.

Fixed Interest – Global & Australia

Global bond yields rose sharply in September, with the US 10-year yield reaching 4.62%, a significant increase from the previous quarter. This led to a 2.1% loss in the Barclays Global Aggregate (AUD hedged) index.

Several factors contributed to this rise, including a stronger US economy and reassessment of the Federal Reserve's future interest rate plans. The US fiscal deficit doubling and concerns about government shutdowns also added to the sell-off.

Inflation in the US rose to 3.7% in August, driven by higher oil prices. In Europe, inflation dropped to 4.3% in September, with weak economic activity, especially in Germany.

The US credit spreads narrowed in recent months, indicating a soft-landing scenario, but the focus on future US Federal Reserve funds rates has increased refinancing risk in credit markets.

High yield spreads ended September at 403 basis points, suggesting moderate concern but still below long-term averages.

Australian bond yields rose to 4.5%, the highest since 2011, influenced by global trends. Australia's strong fiscal position, driven by commodity prices and tax revenue, differs from the US.

The Reserve Bank of Australia (RBA) raised rate expectations but paused due to economic uncertainty, leading to a decline in the Australian dollar.

The RBA, under new governor Michele Bullock, kept rates steady, observing the impact of previous hikes. Inflation rose to 5.2% in August, primarily due to higher fuel and electricity costs.

Despite a gain of 64,000 jobs in August and a 3.7% unemployment rate, the labour market remains tight, with a 4.7% increase in wages. National Australia Bank's business conditions index remains strong, but cost pressures persist.

Commodities

Oil prices rose by 27.3% in the September quarter due to OPEC production cuts. Saudi Arabia and Russia reducing output further boosted oil prices.

Despite China's economic challenges, iron ore prices increased by 5%, reaching US$119.5 per tonne. Copper prices remained stable, but gold declined by 3.7% to US$1870.5 per ounce due to higher real yields and a stronger USD.

Overall, the RBA commodity price index had a slight monthly gain but decreased by almost 17% for the year

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.